Compare commits

10 commits

a957e38e2a

...

596db71abb

| Author | SHA1 | Date | |

|---|---|---|---|

| 596db71abb | |||

| f0cb9a0d38 | |||

| 5450bfe59b | |||

| 9e5fc3a5b5 | |||

| 510839cade | |||

| ec53296603 | |||

| a38a62da0e | |||

| ab0659cfb8 | |||

| ecb08a4fa1 | |||

| 600a4e9885 |

3

.idea/.gitignore

generated

vendored

Normal file

|

|

@ -0,0 +1,3 @@

|

|||

# Default ignored files

|

||||

/shelf/

|

||||

/workspace.xml

|

||||

6

.idea/inspectionProfiles/profiles_settings.xml

generated

Normal file

|

|

@ -0,0 +1,6 @@

|

|||

<component name="InspectionProjectProfileManager">

|

||||

<settings>

|

||||

<option name="USE_PROJECT_PROFILE" value="false" />

|

||||

<version value="1.0" />

|

||||

</settings>

|

||||

</component>

|

||||

7

.idea/misc.xml

generated

Normal file

|

|

@ -0,0 +1,7 @@

|

|||

<?xml version="1.0" encoding="UTF-8"?>

|

||||

<project version="4">

|

||||

<component name="Black">

|

||||

<option name="sdkName" value="Python 3.10" />

|

||||

</component>

|

||||

<component name="ProjectRootManager" version="2" project-jdk-name="Python 3.10" project-jdk-type="Python SDK" />

|

||||

</project>

|

||||

8

.idea/modules.xml

generated

Normal file

|

|

@ -0,0 +1,8 @@

|

|||

<?xml version="1.0" encoding="UTF-8"?>

|

||||

<project version="4">

|

||||

<component name="ProjectModuleManager">

|

||||

<modules>

|

||||

<module fileurl="file://$PROJECT_DIR$/.idea/operation_saylor.iml" filepath="$PROJECT_DIR$/.idea/operation_saylor.iml" />

|

||||

</modules>

|

||||

</component>

|

||||

</project>

|

||||

8

.idea/operation_saylor.iml

generated

Normal file

|

|

@ -0,0 +1,8 @@

|

|||

<?xml version="1.0" encoding="UTF-8"?>

|

||||

<module type="PYTHON_MODULE" version="4">

|

||||

<component name="NewModuleRootManager">

|

||||

<content url="file://$MODULE_DIR$" />

|

||||

<orderEntry type="inheritedJdk" />

|

||||

<orderEntry type="sourceFolder" forTests="false" />

|

||||

</component>

|

||||

</module>

|

||||

6

.idea/vcs.xml

generated

Normal file

|

|

@ -0,0 +1,6 @@

|

|||

<?xml version="1.0" encoding="UTF-8"?>

|

||||

<project version="4">

|

||||

<component name="VcsDirectoryMappings">

|

||||

<mapping directory="" vcs="Git" />

|

||||

</component>

|

||||

</project>

|

||||

6

.vscode/settings.json

vendored

Normal file

|

|

@ -0,0 +1,6 @@

|

|||

{

|

||||

"[markdown]": {

|

||||

"editor.formatOnSave": false,

|

||||

"editor.formatOnType": false

|

||||

}

|

||||

}

|

||||

79

evangelism/episodes/episode_20.md

Normal file

|

|

@ -0,0 +1,79 @@

|

|||

# Operation Saylor - Episode 20/120

|

||||

|

||||

Hi again and welcome to another episode of the Operation Saylor. This is update number 20, corresponding to February 2024.

|

||||

|

||||

If you are reading this for first time, you might want to check [Episode 1](https://stacker.news/items/47539), where my plan and details are explained. That will get you in context.

|

||||

|

||||

---

|

||||

|

||||

## Stats

|

||||

|

||||

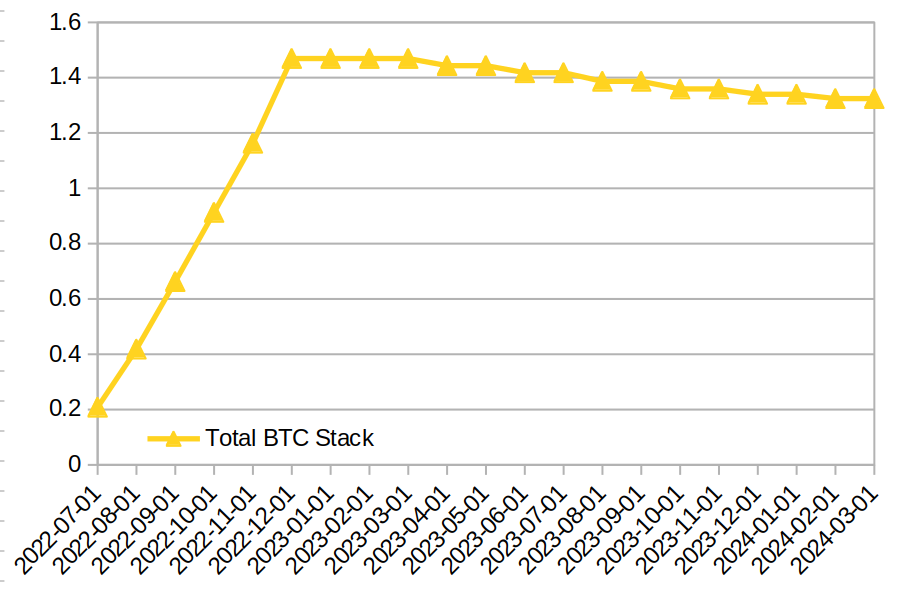

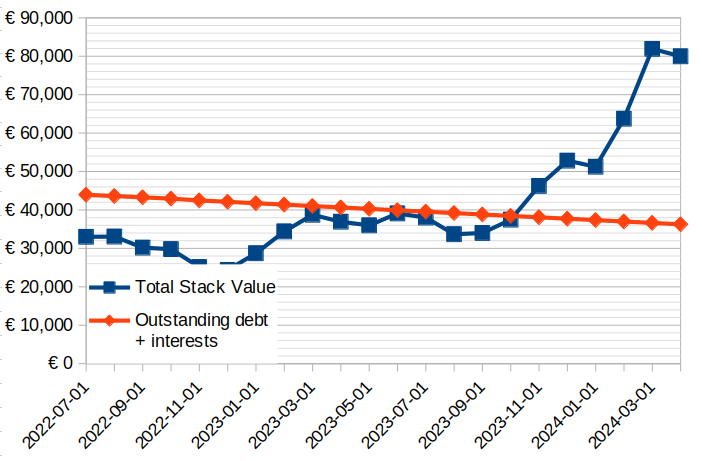

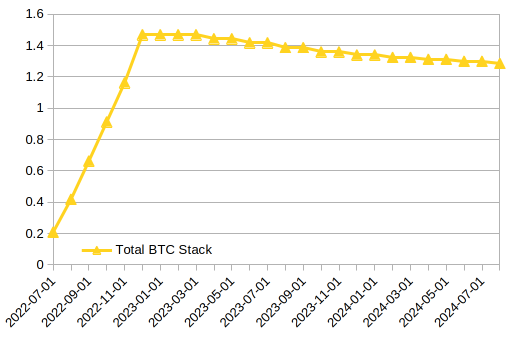

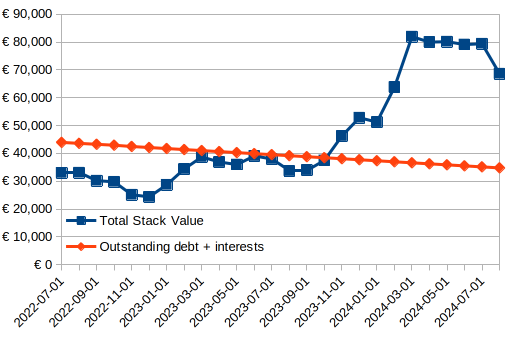

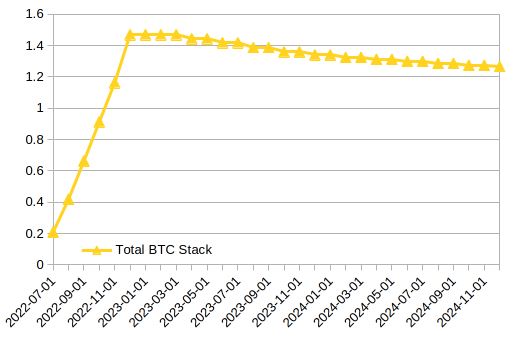

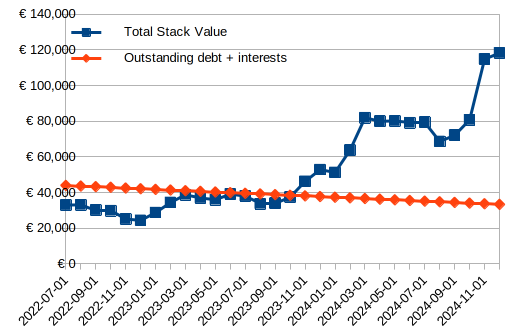

- BTC stack: 1.32429598 BTC

|

||||

- € stack: 442.20 €

|

||||

- Current total value in €: 63,743.55 €

|

||||

- € into BTC: 30,000 €

|

||||

- Paid back to bank: 6,957.80 €

|

||||

- Outstanding debt + interests: 36,986.53 €

|

||||

- Installments to go: 101

|

||||

|

||||

|

||||

## Charts

|

||||

|

||||

[](https://postimg.cc/30NfzbNm)

|

||||

[](https://postimg.cc/vDZK1DhT)

|

||||

|

||||

---

|

||||

|

||||

## Log

|

||||

|

||||

Hello again, and welcome to the February episode of 2024. Apologies for the delay. Life kept getting in the middle.

|

||||

|

||||

Another month goes down, and the bull market sentiment is all around. Reddit has already switched into noobs and memes. I'm glad to see stacker.news still has great content. It truly shows how the zaps upvoting scheme works nicely.

|

||||

|

||||

With the heavy green candles, I see people fantasizing and speculating again about how far can Bitcoin eventually go. Some people fully believe it will eat everything and we will see full-blown hyperbitcoinization and the death of fiat. Others believe Bitcoin will remain a marginal asset, left only to the minority freedom lovers and those who decide to escape the claws of the modern state. And, regardless on what the pictured end scenario is, people also tend to disagree on the timelines. Some tell me we will reach the end of the line in a couple of decades, others think that not even our grandchildren will see the end game playing out.

|

||||

|

||||

I don't know what will happen. Life is so uncertain, the world is so unpredictable, and it is such a huge topic that's on the table. Nevertheless, the other day I found myself exploring an interesting line of thinking with a friend, and I decided to expand it here.

|

||||

|

||||

Out of the different Nostradamus camps, I tend to be on the optimistic, bitcoin-will-eat-everything one. One point that the pessimistic maxis will wield against me often is how damned stupid, ignorant and coward most of the population is. Basically implying they will never have the guts nor the brains to adopt Bitcoin. I tend to agree with that. But I don't think that's an obstacle. Let me explain to you why.

|

||||

|

||||

Picture the entire population living under the fiat system. You have the money printers and cantillionaries, plugged into everyone's veins, sucking their economic life out of them. There is no hope: they are almighty, for they control the ledger, and so no adversary can develop significant economic capital. If most people, all of sudden, decided to jump into Bitcoin, and just unplugged their fiat needles out of their forearms, the cantillionaire house of cards woudl crumble just like that. But we just pointed out that the majority is not up for it. They are busy thinking about getting high on any drug, about how can they grow their dick three inches or about whether, like, Melanie had the right to, like, just start using the same nail polish as them, just like that, without even asking for permission.

|

||||

|

||||

But, not everyone is like that. Some part of the population is and will keep adopting Bitcoin. A minority. You probably know a few. You might be one yourself.

|

||||

|

||||

Now these guys have unplugged the fiat needle out of their forearms. They save, they stack, and they see their networth going up. They have a route outside of the cantillionaire maze, and they can do something they couldn't before: they can accumulate capital.

|

||||

|

||||

Let's draw the starting population map again and include these guys: you have the guys running the money printers. You have the general population being economically drained, unable to grow themselves economically into any significant position. And for the novelty, you have a bunch of Bitcoin-loving wackos that can accumulate capital without limits.

|

||||

|

||||

The general population isn't playing any role here besides being sucked dry. For as long as they don't adopt Bitcoin, they have no resources to significantly escape the economical control of their masters. So you are left with the printers and the Bitcoiners being the only entities that can build out capital. And here's where I believe that the general population doesn't need to adopt Bitcoin: because whatever small amount of Bitcoiners you have, they have the ability to economically grow and create an economy that will eventually be able to suck general population towards it.

|

||||

|

||||

Let's use this series godfather as an example: mister Saylor. He stacks regularly. His networth keeps growing. As Bitcoin reaches higher highs, he accumulates more power. Let's wank our minds and plot a $1M/BTC scenario: in 2020 Michael tweeted he holds 17K BTC personally. Assuming the (unlikely) option that he has changed his position, that means that on our day dreaming scenario his networth due to his Bitcoin stack jumps to 17 billion USD.

|

||||

|

||||

Is he in a position to fight the almighty US Government? No way. A small central-american country? Perhaps. But most importantly, Michael has economic capital to hire thousands of average Joes. Do they need to adopt Bitcoin? Not really. For as long as Michael can pay for their beers, their jes extenders and their nail polish, they will work for him.

|

||||

|

||||

How many Saylor's does it take to accumulate enough gun-powder to hire a significant amount of the population and middle finger the cantillionaire class? I'll leave you thinking about it.

|

||||

|

||||

As always, thanks for reading and I'll see you next month.

|

||||

|

||||

---

|

||||

|

||||

## Previous episodes

|

||||

|

||||

- Episode 1: [https://stacker.news/items/47539](https://stacker.news/items/47539)

|

||||

- Episode 2: [https://stacker.news/items/61708](https://stacker.news/items/61708)

|

||||

- Episode 3: [https://stacker.news/items/71794](https://stacker.news/items/71794)

|

||||

- Episode 4: [https://stacker.news/items/83670](https://stacker.news/items/83670)

|

||||

- Episode 5: [https://stacker.news/items/98216](https://stacker.news/items/98216)

|

||||

- Episode 6: [https://stacker.news/items/111818](https://stacker.news/items/111818)

|

||||

- Episode 7: [https://stacker.news/items/124601](https://stacker.news/items/124601)

|

||||

- Episode 8: [https://stacker.news/items/140816](https://stacker.news/items/140816)

|

||||

- Episode 9: [https://stacker.news/items/154229](https://stacker.news/items/154229)

|

||||

- Episode 10: [https://stacker.news/items/168432](https://stacker.news/items/168432)

|

||||

- Episode 11: [https://stacker.news/items/181336](https://stacker.news/items/181336)

|

||||

- Episode 12: [https://stacker.news/items/197688](https://stacker.news/items/197688)

|

||||

- Episode 13: [https://stacker.news/items/212587](https://stacker.news/items/212587)

|

||||

- Episode 14: [https://stacker.news/items/249798](https://stacker.news/items/249798)

|

||||

- Episode 15: [https://stacker.news/items/265819](https://stacker.news/items/265819)

|

||||

- Episode 16: [https://stacker.news/items/288719](https://stacker.news/items/288719)

|

||||

- Episode 17: [https://stacker.news/items/322189](https://stacker.news/items/322189)

|

||||

- Episode 18: [https://stacker.news/items/363765](https://stacker.news/items/363765)

|

||||

- Episode 19: [https://stacker.news/items/394704](https://stacker.news/items/394704)

|

||||

84

evangelism/episodes/episode_21.md

Normal file

|

|

@ -0,0 +1,84 @@

|

|||

# Operation Saylor - Episode 21/120

|

||||

|

||||

Hi again and welcome to another episode of the Operation Saylor. This is update number 21, corresponding to March 2024.

|

||||

|

||||

If you are reading this for first time, you might want to check [Episode 1](https://stacker.news/items/47539), where my plan and details are explained. That will get you in context.

|

||||

|

||||

---

|

||||

|

||||

## Stats

|

||||

|

||||

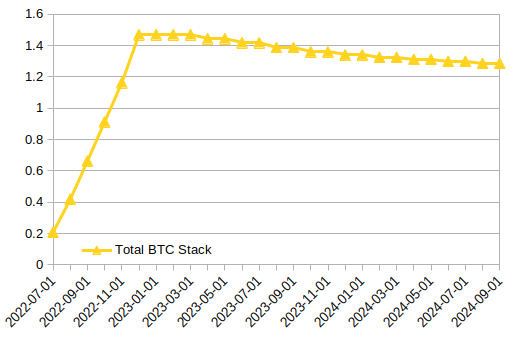

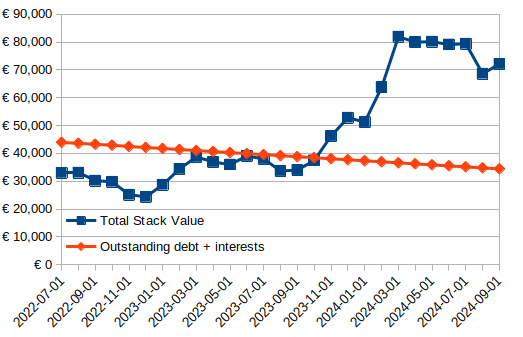

- BTC stack: 1.32429598 BTC

|

||||

- € stack: 76.00 €

|

||||

- Current total value in €: 81,917.49 €

|

||||

- € into BTC: 30,000 €

|

||||

- Paid back to bank: 7,324.00 €

|

||||

- Outstanding debt + interests: 36,620.33 €

|

||||

- Installments to go: 100

|

||||

|

||||

|

||||

## Charts

|

||||

|

||||

[](https://postimg.cc/5H3tvHf7)

|

||||

[](https://postimg.cc/GBr2HPnT)

|

||||

|

||||

---

|

||||

|

||||

## Log

|

||||

|

||||

Hello again, and welcome to a new episode of the series.

|

||||

|

||||

This month I want to deviate a bit from Bitcoin and focus on anarchy. Before I fell into the rabbit hole, I had no clue about anarco-capitalism and thought, just like any normie, that anarchy meant streets on fire and chaos. As years passed and I travelled the rabbit hole, I've slowly grown more and more convinced that anarco-capitalism would be a significantly better system than the one we live in today in most western countries. I don't consider myself an expert at all, and I'm not entirely sure of how could we replace many areas of society, state and government as they are today. But even so, I see a case for trending towards more anarchy in our society.

|

||||

|

||||

Having said this, there's something that worries me deeply: we are not ready. At all.

|

||||

|

||||

As much as I hate the modern state and its proponents for all the misery they have caused, the current state provides a series of tools for us to relate with each other, which are extremely valuable. Things like legal persons, civil codes, property registries, courts, etc. And to live without this stuff takes us back to stone age tribe grade social structures, which is most definitely not how we are going to progress.

|

||||

|

||||

Let me make a simple example: car ownership.

|

||||

|

||||

If you would find yourself selling your car in the wild west, selling would strictly mean giving away the keys to the new owner and kind of be ok with him driving it instead of you. In the modern, state-ran west, selling your car nowadays means much more than that: you are giving away the keys, but you are also leaving a lot of contractual traces in different public registries that trigger the state and most of society to recognise the buyer as the new owner and respect that.

|

||||

|

||||

In the wild west, you are scared shitless of someone taking your car's keys because, if they drive away with them, you're pretty much done. In our reality, you don't care that much, because no thief is going to go happily driving around your car for long, for he will soon enough interact with some entity that will quickly raise a red flag once it realizes this guy doesn't appear in the proper database as the owner.

|

||||

|

||||

In the wild west, you can't provide a loan to someone taking their car as a collateral without also taking physical posession of it. Because you don't even know if the car is actually his. And you are also scared shitless someone might steal the car of this guy, meaning there wouldn't be any asset to take if the loan is not repaid.

|

||||

|

||||

In the wild west, you'll probably be very careful when crossing the street. Because if a car runs you over, and this car doesn't have a plate on it from a strictly maintained and enforced ownership registry, you have no fucking clue on where to go to seek compensation. In the modern west, you are way more confident: unless he delivers a perfect hit and run, it's easy to track down who the hell was responsible for that and seek restitution.

|

||||

|

||||

Now, this is just about car ownership. Think of real-state ownership, labor contracts, marriage, or the gazillion rulings, registries and systems necessary to sustain and operate large businesses that are beyond the mom and pop corner store scale.

|

||||

|

||||

Some wise fellow ancap is probably sitting on the edge of his chair, ready to to type: "well, yeah, but there's no reason the private sector can't provide all of this and, in fact, do it much better than the state". I fully agree with that. Theoretically, it can deliver all of this, and I concur it would probably do it much better than our current structures.

|

||||

|

||||

But you know what? I see absolutely nothing around me. Nothing. Zero. Not even a seed of any of this. If the state would stop providing these services, tomorrow, we wouldn't even have a toy version of any of this.

|

||||

|

||||

The most advanced thing I've seen is pretty much Bitcoin meetups generating small networks that operate like tribes. You have people knowing each other, a few guys probably playing the wise/reliable/respectable old-man of the tribe role. A lot of trust based petty business. Spit on your palm and shake hands grade of contracting. We look pretty much like chimps with Lightning wallets.

|

||||

|

||||

I'm worried because there won't be any orange bright future unless we replace the good stuff the state provides us. Calling for the reduction or the end of the state without strong alternatives to all of its key services is suicidal. Our societies would just fall apart and we would need to start from scratch. And I don't see a lot of thinking done around all of these issues in the bitcoin communities I lurk in.

|

||||

|

||||

I would be curious to know your thoughts on this. Do you share my view on the problem? How do you think this should get solved?

|

||||

|

||||

As always, thanks for reading and I'll see you next month.

|

||||

|

||||

---

|

||||

|

||||

## Previous episodes

|

||||

|

||||

- Episode 1: [https://stacker.news/items/47539](https://stacker.news/items/47539)

|

||||

- Episode 2: [https://stacker.news/items/61708](https://stacker.news/items/61708)

|

||||

- Episode 3: [https://stacker.news/items/71794](https://stacker.news/items/71794)

|

||||

- Episode 4: [https://stacker.news/items/83670](https://stacker.news/items/83670)

|

||||

- Episode 5: [https://stacker.news/items/98216](https://stacker.news/items/98216)

|

||||

- Episode 6: [https://stacker.news/items/111818](https://stacker.news/items/111818)

|

||||

- Episode 7: [https://stacker.news/items/124601](https://stacker.news/items/124601)

|

||||

- Episode 8: [https://stacker.news/items/140816](https://stacker.news/items/140816)

|

||||

- Episode 9: [https://stacker.news/items/154229](https://stacker.news/items/154229)

|

||||

- Episode 10: [https://stacker.news/items/168432](https://stacker.news/items/168432)

|

||||

- Episode 11: [https://stacker.news/items/181336](https://stacker.news/items/181336)

|

||||

- Episode 12: [https://stacker.news/items/197688](https://stacker.news/items/197688)

|

||||

- Episode 13: [https://stacker.news/items/212587](https://stacker.news/items/212587)

|

||||

- Episode 14: [https://stacker.news/items/249798](https://stacker.news/items/249798)

|

||||

- Episode 15: [https://stacker.news/items/265819](https://stacker.news/items/265819)

|

||||

- Episode 16: [https://stacker.news/items/288719](https://stacker.news/items/288719)

|

||||

- Episode 17: [https://stacker.news/items/322189](https://stacker.news/items/322189)

|

||||

- Episode 18: [https://stacker.news/items/363765](https://stacker.news/items/363765)

|

||||

- Episode 19: [https://stacker.news/items/394704](https://stacker.news/items/394704)

|

||||

- Episode 20: [https://stacker.news/items/450792](https://stacker.news/items/450792)

|

||||

98

evangelism/episodes/episode_22.md

Normal file

|

|

@ -0,0 +1,98 @@

|

|||

# Operation Saylor - Episode 22/120

|

||||

|

||||

Hi again and welcome to another episode of the Operation Saylor. This is update number 22, corresponding to April 2024.

|

||||

|

||||

If you are reading this for first time, you might want to check [Episode 1](https://stacker.news/items/47539), where my plan and details are explained. That will get you in context.

|

||||

|

||||

---

|

||||

|

||||

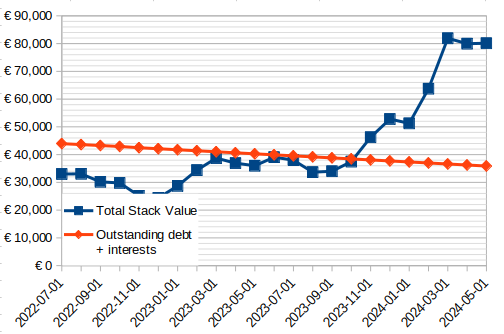

## Stats

|

||||

|

||||

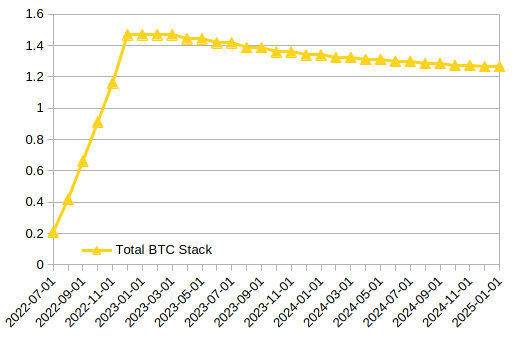

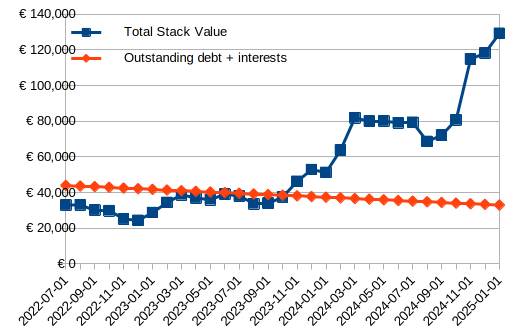

- BTC stack: 1.31191974 BTC

|

||||

- € stack: 459.80 €

|

||||

- Current total value in €: 79962.14 €

|

||||

- € into BTC: 30,000 €

|

||||

- Paid back to bank: 7,690.20 €

|

||||

- Outstanding debt + interests: 36,254.13 €

|

||||

- Installments to go: 99

|

||||

|

||||

|

||||

## Charts

|

||||

|

||||

[](https://postimg.cc/bGBdxpJR)

|

||||

[](https://postimg.cc/qtRz6zkR)

|

||||

|

||||

---

|

||||

|

||||

## Log

|

||||

|

||||

Hello again, and welcome to a new episode of the series.

|

||||

|

||||

Time flies and we are approaching the second anniversary of Operation Saylor. I spent the last anniversary to reflect a bit on the performance of the operation. One of the ideas I brought up is how this operation can be assessed from many angles and with a lot of metrics, which makes it a bit hard to answer the question "How is it going?" in a simple way. This is a topic I have dedicated significant amounts of brain energy, because I believe it deserves thorough attention. Otherwise, you risk getting blinded by the fact that are sitting on a lot of assets, downplaying the fact that you are also sitting on a lot of risk.

|

||||

|

||||

So, in anticipation to the second anniversary, I've decided to let you into my brain. I'll be dedicating this and the next few episodes to discuss in depth my ideas on how to assess the success of Operation Saylor, and we will close the year with some figures.

|

||||

|

||||

### Return and risk

|

||||

|

||||

Let's start somewhere we can all agree on: we save value today so we can spend it in the future. If we save value, and then in some point in the future, we can't spend it for any reason, we have failed big time: the sacrifice was pointless to begin with. There are many reasons and many things that could go wrong and could prevent us from enjoying the value we saved. We could be rugpulled by fiat or crypto means. Someone could steal our savings. We could lose access to them.

|

||||

|

||||

Risk is unavoidable. Nothing is guaranteed. Few things are more sad than looking in the eye at the poor fiat normies that think that keeping their money in regular accounts in the bank is safe (maybe they would be better off if they read this masterpiece by bitstein: https://bitstein.substack.com/p/everyones-a-speculator). But not all saving vehicles come with the same risk, nor do all courses of action do. The balancing factor here is return. The more return, the more risk we are willing to accept. Operation Saylor is an example of high risk, high return.

|

||||

|

||||

Risk and return are commonly studied and discussed in the investing domain, but I see no difference with pretty much any decision around normal savings that would prevent us from borrowing those ideas. And, in my mind, Operation Saylor looks more like saving than investing. If someone borrowed British Pounds to buy Dollars, you wouldn't call that an investment, would you?

|

||||

|

||||

The big point I want to make here is that all courses of action and results should be judged simultaneously for risk and return. Any assessment that only looks at one of them is flawed, for it's easy to have small risk or great return by sacrificing the other. It's easy to look at Operation Saylor and point the finger at the nice number going up, while ignoring the things that could (and still can) go wrong.

|

||||

|

||||

|

||||

### Performance over time

|

||||

|

||||

Another factor that needs to be taken into account is that this Operation lives throughout time, and I also think this should also be reflected in our judgements.

|

||||

|

||||

Imagine two fictional scenarios: the easy-peasy and the plot-twist.

|

||||

|

||||

In the easy-peasy scenario, Bitcoin boomed the day after I began the operation, and stayed stuck at the same price for 10 years. For 10 years, I enjoyed sitting on a massive asset value compared to my liabity towards the bank. By the end of the 10 years, and after paying out the entire loan as planned, I'm left with 1 Bitcoin worth 1 million dollars.

|

||||

|

||||

In the plot-twist scenario, Bitcoin barely sees any price action after I began the operation. Loan installments slowly erode the Operation's Bitcoin stack, with the Operation stack value and the amount owed to the bank closely tracking each other. By the time the 10 years are coming to an end, there's only a bit of sats left. But, a miracle happens, and in the last month, Bitcoin's price suddenly flies to 10M USD/BTC. I still have 1 million sats left, so the end story is I have 0.01 Bitcon worth 1 million dollars.

|

||||

|

||||

In both scenarios, I've made all the payments to the bank and I'm left with a stack of BTC worth 1 million dollars. If you only look at returns at close, there is no difference measured in fiat. But, let me ask you, would you consider both scenarios equally good?

|

||||

|

||||

I don't. I would clearly prefer the easy-peasy scenario. The reason is simple: for a longer period of time, I was sitting on little risk. The assets I was holding were much more valuable that the liabilities that I was facing. Should I had had to sell due to some catastrophic personal situation in the middle of the operation, it wouldn't have hurt much. Or should I have had to reconsider my asset allocation due to some radical change in the worlds circunstances, I would have been sitting on a lot of value to reallocate. Had any of this happened in the plot-twist scenario before reaching the final miracle, I would have been screwed. Left with a debt to a bank and little to no assets.

|

||||

|

||||

My point for you here is: it's not only the end result, but also the state of things over the entire life of the operation, that determines if the operation was successful.

|

||||

|

||||

|

||||

### No DCA

|

||||

|

||||

Finally, some people in the past have tried to compare the performance of this operation to the performance of having DCA'd all the installment payments. One could naively think: if DCAing the installments into Bitcoin leaves you with more BTC at the end of the operation that the loan option, then the DCA was better.

|

||||

|

||||

It's an interesting exercise, but it's flawed. You wouldn't be comparing apples to apples. The reason is that the DCA option implies that you have a nice cashflow that allows to add funds to your stack every month. Operation Saylor, on the other hand, is self-sustained (for as long as the Bitcoin stack doesn't run dry and forces me to pay the loan installments out of my pocket).

|

||||

|

||||

If anything, what would be a fair comparison is to compare the DCA plan to running Operation Saylor, but paying the installments with my personal cashflows instead of shaving off a few sats every couple of months from the Operation stack. This makes a fair comparison: both scenarios commit 366.20€ per month, either to buying Bitcoin or to paying to the bank. I might explore this in our upcoming episodes.

|

||||

|

||||

|

||||

I'll leave it here for today. I hope these ideas set some foundations and help you see, as I do, that there's more nuance to judging Operation Saylor than just looking at the total value held. As always, thanks for reading and I'll see you next month.

|

||||

|

||||

---

|

||||

|

||||

## Previous episodes

|

||||

|

||||

- Episode 1: [https://stacker.news/items/47539](https://stacker.news/items/47539)

|

||||

- Episode 2: [https://stacker.news/items/61708](https://stacker.news/items/61708)

|

||||

- Episode 3: [https://stacker.news/items/71794](https://stacker.news/items/71794)

|

||||

- Episode 4: [https://stacker.news/items/83670](https://stacker.news/items/83670)

|

||||

- Episode 5: [https://stacker.news/items/98216](https://stacker.news/items/98216)

|

||||

- Episode 6: [https://stacker.news/items/111818](https://stacker.news/items/111818)

|

||||

- Episode 7: [https://stacker.news/items/124601](https://stacker.news/items/124601)

|

||||

- Episode 8: [https://stacker.news/items/140816](https://stacker.news/items/140816)

|

||||

- Episode 9: [https://stacker.news/items/154229](https://stacker.news/items/154229)

|

||||

- Episode 10: [https://stacker.news/items/168432](https://stacker.news/items/168432)

|

||||

- Episode 11: [https://stacker.news/items/181336](https://stacker.news/items/181336)

|

||||

- Episode 12: [https://stacker.news/items/197688](https://stacker.news/items/197688)

|

||||

- Episode 13: [https://stacker.news/items/212587](https://stacker.news/items/212587)

|

||||

- Episode 14: [https://stacker.news/items/249798](https://stacker.news/items/249798)

|

||||

- Episode 15: [https://stacker.news/items/265819](https://stacker.news/items/265819)

|

||||

- Episode 16: [https://stacker.news/items/288719](https://stacker.news/items/288719)

|

||||

- Episode 17: [https://stacker.news/items/322189](https://stacker.news/items/322189)

|

||||

- Episode 18: [https://stacker.news/items/363765](https://stacker.news/items/363765)

|

||||

- Episode 19: [https://stacker.news/items/394704](https://stacker.news/items/394704)

|

||||

- Episode 20: [https://stacker.news/items/450792](https://stacker.news/items/450792)

|

||||

- Episode 21: [https://stacker.news/items/476945](https://stacker.news/items/476945)

|

||||

86

evangelism/episodes/episode_23.md

Normal file

|

|

@ -0,0 +1,86 @@

|

|||

# Operation Saylor - Episode 23/120

|

||||

|

||||

Hi again and welcome to another episode of the Operation Saylor. This is update number 23, corresponding to May 2024.

|

||||

|

||||

If you are reading this for first time, you might want to check [Episode 1](https://stacker.news/items/47539), where my plan and details are explained. That will get you in context.

|

||||

|

||||

---

|

||||

|

||||

## Stats

|

||||

|

||||

- BTC stack: 1.31191974 BTC

|

||||

- € stack: 93.60 €

|

||||

- Current total value in €: 80,120.70 €

|

||||

- € into BTC: 30,000 €

|

||||

- Paid back to bank: 8,056.40 €

|

||||

- Outstanding debt + interests: 35,887.93 €

|

||||

- Installments to go: 98

|

||||

|

||||

|

||||

## Charts

|

||||

|

||||

[](https://postimg.cc/5XDQtg54)

|

||||

[](https://postimg.cc/G44srVyg)

|

||||

|

||||

---

|

||||

|

||||

## Log

|

||||

|

||||

Hello again, and welcome to a new episode of the series.

|

||||

|

||||

Today I want to continue with my thoughts on measuring performance that I started in the previous episode. Last month I discussed about risk and return to make the point on how we need to make comparisons using both of them if we want such comparisons to be relevant and useful. I also introduced the idea of performance only being truly understandable along the time dimension. It's not only the end result, but the state of the operation during all of its lifespan that should be accounted for. Finally, I made the point on how a naive comparison against a simple DCA just doesn't make sense.

|

||||

|

||||

This month, I want to continue the conversation by presenting two metrics that are key for our performance measuring exercise, and that I monitor every month even if I don't always report them in our monthly updates.

|

||||

|

||||

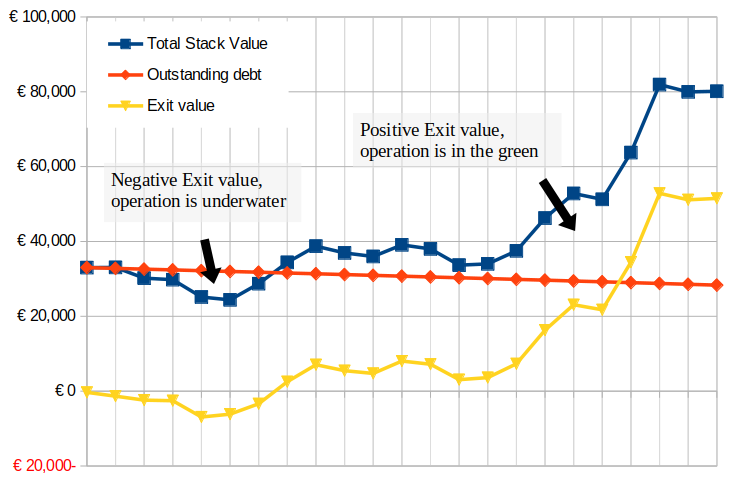

The first metric is quite straightforward. I call it exit value.

|

||||

|

||||

Exit value would be the financial outcome resulting of me cancelling the loan on any given day by selling whatever was needed from the Bitcoin stack. It's a metric that can be computed at any point in time, since my loan can always be repaid early and in full. The rough formula would be:

|

||||

|

||||

Exit Value = (€ Value of Bitcoin Stack + € Value of Euros Stack) - (Outstanding Principal * 1.01)

|

||||

|

||||

*That magic 1.01 is explained by the fact that my loan has an early amortization penalty of 1% of the early amortized value. If I make an additional amortization of 100€ beyond my usual installments, the bank will actually charge 101€.*

|

||||

|

||||

The concept is simple, right? What would be left for me if I change plans and chicken out of Operation Saylor. If on any given day the value of the Bitcoin I hold is larger than the 101% of the outstanding principal, the exit value is positive, which means I would come ahead with some extra value. On the other hand, if my Bitcoin stack is underwater and can't cover the outstanding amount, the exit value is negative. This reflects that I simply can't kill the loan just with the stack, and that I could either surrender to that or put more money out of my pocket to cover the difference. In this case, the outcome would be net negative for me.

|

||||

|

||||

Okay, now that hopefully you get the idea, let's take a glimpse at how Exit Value has looked like so far through Operation Saylor:

|

||||

|

||||

[](https://postimg.cc/ZWg97HCk)

|

||||

|

||||

The story tells itself pretty much: Operation Saylor stayed under water for a bit at the start as the bear market touched its bottom, and then we've been going up. It's been long now since the exit value has been negative.

|

||||

|

||||

In the previous episode, I used the [easy-peasy and plot-twist scenarios](https://stacker.news/items/522161?commentId=523063#performance-over-time) to illustrate two scenarios that end with the same balance but take very different paths during the lifespan of the Operation. Now that we are on the same page on the concept of Exit Value, the conversation becomes more fluent: the easy-peasy scenario is easy-peasy precisely because it holds a positive exit value all the time. The plot-twist scenario, on the other hand, is a painful path to success because I wouldn't have enjoyed that nice exit value situation.

|

||||

|

||||

Summing things up: positive Exit Value over time, good. Negative Exit Value over time, bad.

|

||||

|

||||

Finally, let's look at the second metric. Any two courses of action or scenarios could have different shapes of Exit Value. Comparing them is an exercise that you can do in many ways. Personally, my simple and quick shot at this is to run the integral of the Exit Value over time, which leads to a simple, single value that summarizes things nicely. If you are not mathematically inclined, simply think of it as: the more time I've stayed with a positive Exit Value, and the higher it was, the better. The more time I've stayed with a negative one, and the lower it was, the worse. The integral pretty much sums both facts up into a single number.

|

||||

|

||||

I'm not going to plot this now for you since the integral only becomes interesting when compared against some other scenario. We will leave that for further episodes.

|

||||

|

||||

I'll leave it here for today. I hope you found the episode interesting and that these concepts help you better assess your own options. As always, thanks for reading and I'll see you next month.

|

||||

|

||||

---

|

||||

|

||||

## Previous episodes

|

||||

|

||||

- Episode 1: [https://stacker.news/items/47539](https://stacker.news/items/47539)

|

||||

- Episode 2: [https://stacker.news/items/61708](https://stacker.news/items/61708)

|

||||

- Episode 3: [https://stacker.news/items/71794](https://stacker.news/items/71794)

|

||||

- Episode 4: [https://stacker.news/items/83670](https://stacker.news/items/83670)

|

||||

- Episode 5: [https://stacker.news/items/98216](https://stacker.news/items/98216)

|

||||

- Episode 6: [https://stacker.news/items/111818](https://stacker.news/items/111818)

|

||||

- Episode 7: [https://stacker.news/items/124601](https://stacker.news/items/124601)

|

||||

- Episode 8: [https://stacker.news/items/140816](https://stacker.news/items/140816)

|

||||

- Episode 9: [https://stacker.news/items/154229](https://stacker.news/items/154229)

|

||||

- Episode 10: [https://stacker.news/items/168432](https://stacker.news/items/168432)

|

||||

- Episode 11: [https://stacker.news/items/181336](https://stacker.news/items/181336)

|

||||

- Episode 12: [https://stacker.news/items/197688](https://stacker.news/items/197688)

|

||||

- Episode 13: [https://stacker.news/items/212587](https://stacker.news/items/212587)

|

||||

- Episode 14: [https://stacker.news/items/249798](https://stacker.news/items/249798)

|

||||

- Episode 15: [https://stacker.news/items/265819](https://stacker.news/items/265819)

|

||||

- Episode 16: [https://stacker.news/items/288719](https://stacker.news/items/288719)

|

||||

- Episode 17: [https://stacker.news/items/322189](https://stacker.news/items/322189)

|

||||

- Episode 18: [https://stacker.news/items/363765](https://stacker.news/items/363765)

|

||||

- Episode 19: [https://stacker.news/items/394704](https://stacker.news/items/394704)

|

||||

- Episode 20: [https://stacker.news/items/450792](https://stacker.news/items/450792)

|

||||

- Episode 21: [https://stacker.news/items/476945](https://stacker.news/items/476945)

|

||||

- Episode 22: [https://stacker.news/items/522161](https://stacker.news/items/522161)

|

||||

116

evangelism/episodes/episode_24.md

Normal file

|

|

@ -0,0 +1,116 @@

|

|||

# Operation Saylor - Episode 24/120

|

||||

|

||||

Hi again and welcome to another episode of the Operation Saylor. This is update number 24, corresponding to June 2024.

|

||||

|

||||

If you are reading this for first time, you might want to check [Episode 1](https://stacker.news/items/47539), where my plan and details are explained. That will get you in context.

|

||||

|

||||

---

|

||||

|

||||

## Stats

|

||||

|

||||

- BTC stack: 1.29952304BTC

|

||||

- € stack: 477.40 €

|

||||

- Current total value in €: 79,098.54 €

|

||||

- € into BTC: 30,000 €

|

||||

- Paid back to bank: 8,422.60 €

|

||||

- Outstanding debt + interests: 35,521.73 €

|

||||

- Installments to go: 97

|

||||

|

||||

|

||||

## Charts

|

||||

|

||||

[](https://postimg.cc/rDYgXf70)

|

||||

[](https://postimg.cc/gwXsYvPM)

|

||||

|

||||

---

|

||||

|

||||

## Log

|

||||

|

||||

Hello again, and welcome to a new episode of the series. Today, we finalize with the handful of episodes that I want to dedicate to discuss how to measure the performance of Operation Saylor.

|

||||

|

||||

As a reminder, on [Episode 22](https://stacker.news/items/522161) I discussed the relevance of taking both risk and return into account, how I believe performance is a function that goes through all time and not just until the end of the Operation, and why comparing against DCA doesn't make all the sense. On [Episode 23](https://stacker.news/items/550749), I presented to you the Exit Value metric, as well as its time-accounting derivative, the Integrated Exit Value.

|

||||

|

||||

On this episode, I want to leverage that we are now a bit on the same page since the previous definitions and explanations, and use that to run something more fun: comparing Operation Saylor against another course of action, much more traditional and frequently recommended.

|

||||

|

||||

Now, you might remember from Episode 22 how I discussed that comparing Operation Saylor against simply DCA-ing the equivalent of the loan installments wasn't valid, for Operation Saylor is a cashflow free that doesn't require me adding funds regularly. DCA-ing, on the other hand, would require me to add funds each month. Thus, we would be comparing apples to oranges.

|

||||

|

||||

Nevertheless, I _really_ want to compare this against a normal DCA. To make this possible, I'm going to play a small trick and present to you a theoretical course of action I'll dub DCSAY. DCSAY is simply playing an imaginary parallel universe where I would have run Operation Saylor identically to what I've described so far, with the only caveat that I would have paid the loan installments from my personal pocket instead of using the Operation's stack. Because of this, in DCSAY, I would have simply built up my bitcoin stack at the beginning of the story and I would have never sold a single sat, but used my personal euro funds instead.

|

||||

|

||||

Now, because this hypothetical backtest, just like a normal DCA, implies paying out 366.20€ each month out of my pocket, we're back to comparing apples to apples territory. It is not a fully honest comparison towards the real Operation, but it serves well the purpose I'm after: comparing the risk/return of taking the loan or not.

|

||||

|

||||

Okay, now that's been quite a few hoops we jumped and we still didn't start with the juicy bit. So, you might be wondering, why all the trouble to benchmark against the DCA?

|

||||

|

||||

One of my frustrations before I started Operation Saylor, and one of the reasons I started writing about it, was how commonly borrowing fiat to buy bitcoin was (and is) regarded as a crazy, irresponsible and mindless thing to do without any kind of analysis. And I'm not even talking about normies thinking such things: to them, just buying bitcoin is already beyond salvation, no need to bother with leverage. What got me was seeing seasoned Bitcoiners everywhere jumping into such a mental shortcut, while disregarding first principles thinking. My hope when I started writing was that Operation Saylor could serve as a corner of discussion for this topic, as a real story that would describe in high precision and step by step how doing this looks and feels like, and also just as a bit of good old leading by example.

|

||||

|

||||

As time has passed, I've spent more and more time reflecting on this topic and I've also learned a thing or two along the way. With this experience, I've changed my mind: now, not only I think that borrowing fiat to buy Bitcoin is not crazy, but I actually think that for many people [^1] it is, within certain bounds, a vastly superior strategy to DCA.

|

||||

|

||||

So, I'm hoping many of such people can read this comparison and at least give it some thinking.

|

||||

|

||||

Now, enough setting the foundations and justifying. Let's compare some numbers, shall we? For the following figures, DCA means doing DCA with the equivalent to the loan installments. DCSAY I've already explained above. Any other factors I haven't covered in detail (when to buy bitcoin, the price over time, etc) you can assume to be identical to the real Operation Saylor.

|

||||

|

||||

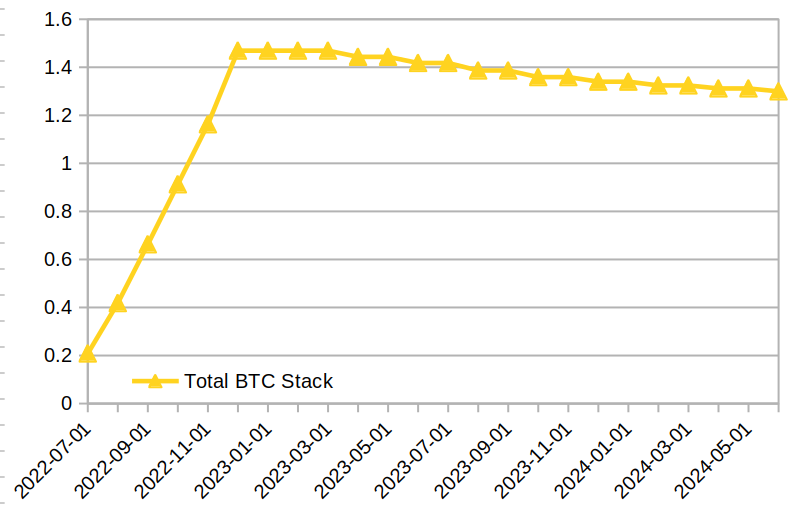

Let's begin with a simple one: the size of the Bitcoin stacks for each strategy:

|

||||

|

||||

[](https://postimg.cc/yJdC1pfF)

|

||||

|

||||

Now, that's a predictable one. DCSAY means making a handful of big purchases during the first six months and then staying there. DCA keeps on adding slowly. Obviously, DCSAY has the upper hand here. But then again, it would be foolish to ignore the liability that exists in DCSAY and does not in the DCA. I would also like to direct your attention to the steepness of the orange line: it's not that noticable, but you can see its growth is slowing down. As sats get more precious, the DCA strategy has more trouble to climb against the DCSAY stack. We'll have to wait eight more years to find out if the lines ever cross.

|

||||

|

||||

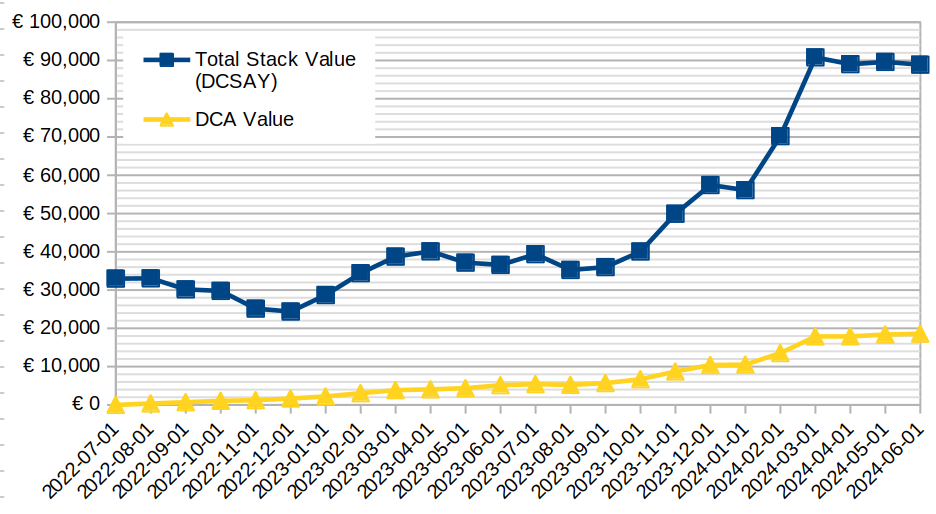

Let's look at both in fiat terms:

|

||||

|

||||

[](https://postimg.cc/9rh3RQ8X)

|

||||

|

||||

Kind of the same story as the Bitcoin denominated time, just with the added touch of reflecting the volatility in the BTC-EUR price. Nothing to see here besides flashy fiat amounts.

|

||||

|

||||

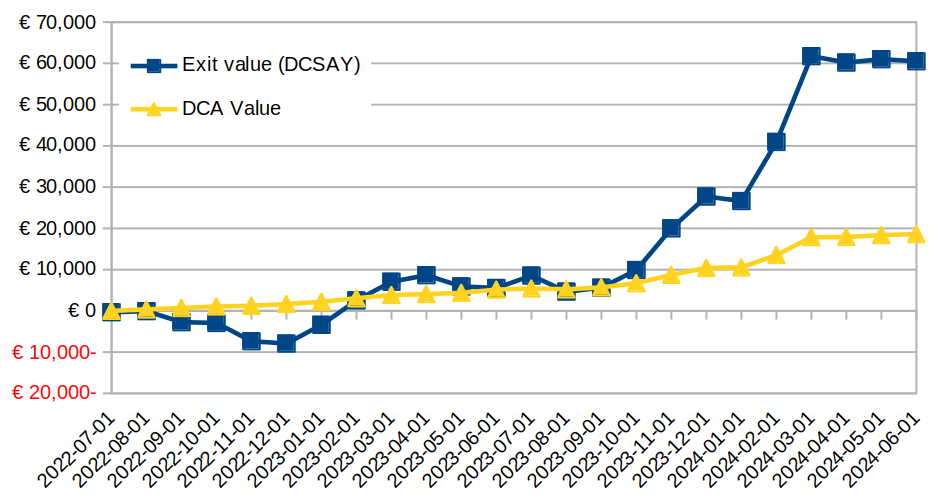

Next, we look into something way more interesting and relevant: the Exit Value. Note that, in the case of the DCA option, since there's no liability at all, the Exit Value is simply the value of the DCA stack itself.

|

||||

|

||||

[](https://postimg.cc/XB9THRJ0)

|

||||

|

||||

Now, this is something else. The first observation is how the Y-axis negative area comes to life: with the introduction of liabilities into the comparison comes the fact that DCSAY (and generally, any strategy that borrows money) can go negative. Here, the DCA option can flex: you might accumulate more or less, but you won't ever step into red numbers territory.

|

||||

|

||||

In late 2022, with the bear market still heading towards the local bottom, DCSAY stayed in the red for quite a bit. This is the kind of risky exposure that borrowing fiat comes with, and that should clearly be taken into account when judging options. Nevertheless, as we got through the FTX drama, DCSAY caught up with DCA and boomed afterwards, with an upside that has been much stronger than the previous downside.

|

||||

|

||||

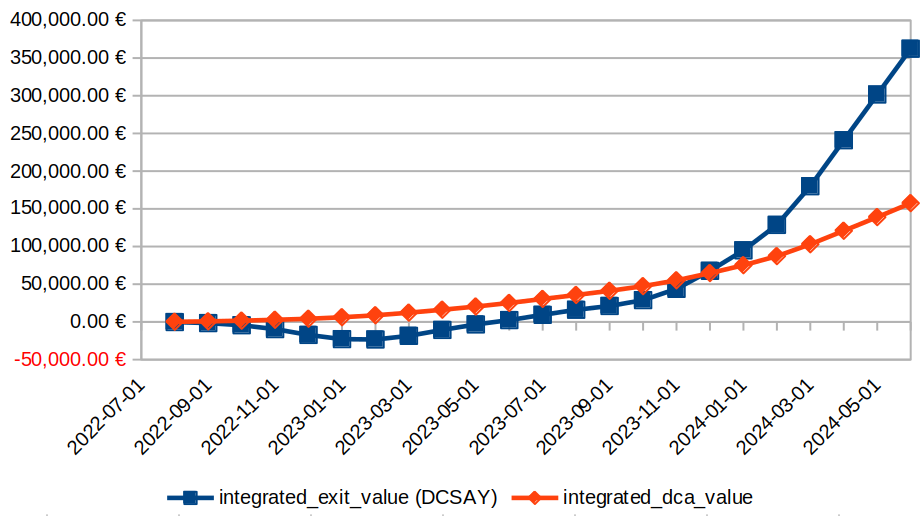

The final chart I want to show you condenses all of this in one picture:

|

||||

|

||||

[](https://postimg.cc/tsqLkmGL)

|

||||

|

||||

Don't get blinded by the Y-axis values: what you see is an integral, so it's not really euros we are measuring there. The integral accumulates negative values everytime we spend a month in the red (negative Exit Value) and grows everytime we spend a month in the green (positive Exit Value). The more intense the green/red, the more the curve climbs/drops. Every month in the history counts, and so staying in deep red penalises you forever, just like being heavily in the green rewards you.

|

||||

|

||||

The simple way: higher is better.

|

||||

|

||||

Now, the DCA strategy can't ever go into negative territory here, since its Exit Value can't be negative due to the lack of liabilities. And it took the lead against DCSAY for a long time because of that early period in the bear market when things were looking bleak. But the recent pumps of 2024 allowed DCSAY to clearly overtake the DCA. It makes sense: the sourness of a few months being in the red in 4-figures magnitude don't cover up the sweetness of being in the green in 5-figures magnitude.

|

||||

|

||||

So, the comparison begs the question: did DCSAY, the slightly modified cousin of Operation Saylor, beat DCA-ing? My conclusion is it clearly did, as shown in the monster gap that we are now experiencing in the last graph. Although let's keep in mind we are early and this chart can evolve in volatile ways as time passes. I don't want to sell the skin before we hunt the bear.

|

||||

|

||||

Also, this doesn't mean the DCSAY strategy is going to beat any DCA. The timing I experienced was extremely good, pretty much nailing the entry in 2022's bear market. Different entry points would lead to different pictures, some nastier and some prettier. This is another interesting line of analysis that I'll hopefully tackle some other time in the series.

|

||||

|

||||

I hope you enjoyed this and the last couple of episodes. With this episode, we'll conclude the barrage of numbers and metrics. Next month will be time to reflect a bit and celebrate the second anniversay of the Operation. As always, thanks for reading and I'll see you next month.

|

||||

|

||||

|

||||

[^1]: I wouldn't consider borrowing a good strategy for everyone. But for those individuals and families that (1) are currently out of debt, (2) have stable incomes that can survive recessions and (3) have strong saving rates and can be confident costs won't eat them up, it feels like a no brainer. Discussions might be held around what amount to borrow, and what's a good enough interest for it. But, making an extreme case: if such a profile was offered to borrow a 100€ for a 100 years at a 1% APR... why not do it?

|

||||

|

||||

---

|

||||

|

||||

## Previous episodes

|

||||

|

||||

- Episode 1: [https://stacker.news/items/47539](https://stacker.news/items/47539)

|

||||

- Episode 2: [https://stacker.news/items/61708](https://stacker.news/items/61708)

|

||||

- Episode 3: [https://stacker.news/items/71794](https://stacker.news/items/71794)

|

||||

- Episode 4: [https://stacker.news/items/83670](https://stacker.news/items/83670)

|

||||

- Episode 5: [https://stacker.news/items/98216](https://stacker.news/items/98216)

|

||||

- Episode 6: [https://stacker.news/items/111818](https://stacker.news/items/111818)

|

||||

- Episode 7: [https://stacker.news/items/124601](https://stacker.news/items/124601)

|

||||

- Episode 8: [https://stacker.news/items/140816](https://stacker.news/items/140816)

|

||||

- Episode 9: [https://stacker.news/items/154229](https://stacker.news/items/154229)

|

||||

- Episode 10: [https://stacker.news/items/168432](https://stacker.news/items/168432)

|

||||

- Episode 11: [https://stacker.news/items/181336](https://stacker.news/items/181336)

|

||||

- Episode 12: [https://stacker.news/items/197688](https://stacker.news/items/197688)

|

||||

- Episode 13: [https://stacker.news/items/212587](https://stacker.news/items/212587)

|

||||

- Episode 14: [https://stacker.news/items/249798](https://stacker.news/items/249798)

|

||||

- Episode 15: [https://stacker.news/items/265819](https://stacker.news/items/265819)

|

||||

- Episode 16: [https://stacker.news/items/288719](https://stacker.news/items/288719)

|

||||

- Episode 17: [https://stacker.news/items/322189](https://stacker.news/items/322189)

|

||||

- Episode 18: [https://stacker.news/items/363765](https://stacker.news/items/363765)

|

||||

- Episode 19: [https://stacker.news/items/394704](https://stacker.news/items/394704)

|

||||

- Episode 20: [https://stacker.news/items/450792](https://stacker.news/items/450792)

|

||||

- Episode 21: [https://stacker.news/items/476945](https://stacker.news/items/476945)

|

||||

- Episode 22: [https://stacker.news/items/522161](https://stacker.news/items/522161)

|

||||

- Episode 23: [https://stacker.news/items/550749](https://stacker.news/items/550749)

|

||||

72

evangelism/episodes/episode_25.md

Normal file

|

|

@ -0,0 +1,72 @@

|

|||

# Operation Saylor - Episode 25/120

|

||||

|

||||

Hi again and welcome to another episode of the Operation Saylor. This is update number 25, corresponding to July 2024.

|

||||

|

||||

If you are reading this for first time, you might want to check [Episode 1](https://stacker.news/items/47539), where my plan and details are explained. That will get you in context.

|

||||

|

||||

---

|

||||

|

||||

## Stats

|

||||

|

||||

- BTC stack: 1.29952304BTC

|

||||

- € stack: 111.20 €

|

||||

- Current total value in €: 79,382.11 €

|

||||

- € into BTC: 30,000 €

|

||||

- Paid back to bank: 8,788.80 €

|

||||

- Outstanding debt + interests: 35,155.53 €

|

||||

- Installments to go: 96

|

||||

|

||||

|

||||

## Charts

|

||||

|

||||

[](https://postimg.cc/rRNK4yy3)

|

||||

[](https://postimg.cc/yWmJtjhj)

|

||||

|

||||

---

|

||||

|

||||

## Log

|

||||

|

||||

Hello again and welcome to the second anniversary of Operation Saylor. This month we are 24 months into the Operation, with 96 ahead of us. I'm very glad to celebrate another anniversary of this little project of mine in good shape, with a great record behind us and a good outlook for the future.

|

||||

|

||||

The vibes in the air are completely different from when I started this. Two years ago, we were deep into the bear market. We still had not hit rock bottom, but we were pretty close to it. Leveraged players were bleeding, dodgy custodians and CEXs were dropping dead left and right, and reddit was dry of memes. In comparison, now I feel everyone is cheerful about the gains in the past 18 months, and strongly convinced that we have a bull market ready to unfold in the next 18 months. People are back to convincing their aunties that buying Bitcoin is a good idea, normies are happily throwing themselves into the ETFs and reddit is packed with memes. We will see how things unfold.

|

||||

|

||||

On our little corner here, things have been running great. It's been another good year in Operation Saylor: we've stuck to the plan, had no black swans of any kind, and numbers are looking good. As we had the chance to review together in the past episodes, the performance of this bet is working out nicely.

|

||||

|

||||

And talking about performance, let me discuss it again but switching the tone from all the cold, analytical approaches we had in the past episodes: this shit is doing great. The value of the stack has been higher than the total debt for almost a year now, and given the phase of the market we are in, I'm pretty confident we probably won't ever go below the total debt again. It's humbling to see how the current gains are already bigger than the yearly salary of many people where I live, which I've been able to accumulate with little effort (although quite a bit of risk).

|

||||

|

||||

I keep being confident on this playbook. The original rationale that drove me to begin Operation Saylor still makes all the sense, and if anything, empirical evidence from both my own experience and also what other players in the markets have been doing seems to validate it. I also still think that there's a lot of people out there that are missing out and could be benefit from an approach like this, but keep chickening away because of the dogma that picking up debt is bad. I personally find this to be a pity, because the more of us that we would run a play like this, the more we would pump the price and accelerate adoption. I guess it will take a lot more education and even more fiat debasement for more people to open their eyes to how this kind of play makes sense.

|

||||

|

||||

And let me tell you something: I'll most probably repeat this pattern again in the future. It made sense back in 2022, it makes sense today, and it will probably keep on making sense for a few decades as the fiat house of cards heads towards collapse. I've also reflected on how repeatedly pulling the get-debt-to-buy-bitcoin lever is a risk decreasing action: just like when we DCA, by spinning the roulette multiple times, we minimize the risk of hitting a terrible timing. As long as the chances of coming out ahead with a positive result are above 50%, increasing the number of spins reduces the risk of losing overall. It also reduces the possibility of an outrageous win. But, in my opinion, aiming for that would be sheer gambling, not proper financial planning. Just like Lyn Alden stated about herself in her last newsletter, I'm in the area of spotting long-term trends that I can win with, not throwing dice.

|

||||

|

||||

Opening up the door to adding more debt brings a few questions to the table: When? How much? What's the max interest rate that's bearable? Overall, what's the right amount of risk? And how do you even measure it? These are all questions I'm currently working on answering for myself. I guess we each need to find our personal answers for these, since many of them are unavoidably tightly related to our personal finances and our life in general. I'm not in a rush, since I'm comfortable with the level of liabilities I'm sitting on today and don't feel any FOMO to pile up more of them fiat liabilities.

|

||||

|

||||

Thanks for sticking around for another year. I hoped you enjoyed this episode as well as all of the last year. Let's see what awaits for us in the next 12 months and what we will be looking back to in the next anniversary. As always, thanks for reading and I'll see you next month.

|

||||

|

||||

---

|

||||

|

||||

## Previous episodes

|

||||

|

||||

- Episode 1: [https://stacker.news/items/47539](https://stacker.news/items/47539)

|

||||

- Episode 2: [https://stacker.news/items/61708](https://stacker.news/items/61708)

|

||||

- Episode 3: [https://stacker.news/items/71794](https://stacker.news/items/71794)

|

||||

- Episode 4: [https://stacker.news/items/83670](https://stacker.news/items/83670)

|

||||

- Episode 5: [https://stacker.news/items/98216](https://stacker.news/items/98216)

|

||||

- Episode 6: [https://stacker.news/items/111818](https://stacker.news/items/111818)

|

||||

- Episode 7: [https://stacker.news/items/124601](https://stacker.news/items/124601)

|

||||

- Episode 8: [https://stacker.news/items/140816](https://stacker.news/items/140816)

|

||||

- Episode 9: [https://stacker.news/items/154229](https://stacker.news/items/154229)

|

||||

- Episode 10: [https://stacker.news/items/168432](https://stacker.news/items/168432)

|

||||

- Episode 11: [https://stacker.news/items/181336](https://stacker.news/items/181336)

|

||||

- Episode 12: [https://stacker.news/items/197688](https://stacker.news/items/197688)

|

||||

- Episode 13: [https://stacker.news/items/212587](https://stacker.news/items/212587)

|

||||

- Episode 14: [https://stacker.news/items/249798](https://stacker.news/items/249798)

|

||||

- Episode 15: [https://stacker.news/items/265819](https://stacker.news/items/265819)

|

||||

- Episode 16: [https://stacker.news/items/288719](https://stacker.news/items/288719)

|

||||

- Episode 17: [https://stacker.news/items/322189](https://stacker.news/items/322189)

|

||||

- Episode 18: [https://stacker.news/items/363765](https://stacker.news/items/363765)

|

||||

- Episode 19: [https://stacker.news/items/394704](https://stacker.news/items/394704)

|

||||

- Episode 20: [https://stacker.news/items/450792](https://stacker.news/items/450792)

|

||||

- Episode 21: [https://stacker.news/items/476945](https://stacker.news/items/476945)

|

||||

- Episode 22: [https://stacker.news/items/522161](https://stacker.news/items/522161)

|

||||

- Episode 23: [https://stacker.news/items/550749](https://stacker.news/items/550749)

|

||||

- Episode 24: [https://stacker.news/items/583121](https://stacker.news/items/583121)

|

||||

72

evangelism/episodes/episode_26.md

Normal file

|

|

@ -0,0 +1,72 @@

|

|||

# Operation Saylor - Episode 26/120

|

||||

|

||||

Hi again and welcome to another episode of the Operation Saylor. This is update number 26, corresponding to August 2024.

|

||||

|

||||

If you are reading this for first time, you might want to check [Episode 1](https://stacker.news/items/47539), where my plan and details are explained. That will get you in context.

|

||||

|

||||

---

|

||||

|

||||

## Stats

|

||||

|

||||

- BTC stack: 1.28537210BTC

|

||||

- € stack: 495.00 €

|

||||

- Current total value in €: 68,619.72 €

|

||||

- € into BTC: 30,000 €

|

||||

- Paid back to bank: 9,155.00 €

|

||||

- Outstanding debt + interests: 34,789.33 €

|

||||

- Installments to go: 95

|

||||

|

||||

|

||||

## Charts

|

||||

|

||||

[](https://postimg.cc/Tp6CWn5c)

|

||||

[](https://postimg.cc/JtJpnp0n)

|

||||

|

||||

---

|

||||

|

||||

## Log

|

||||

|

||||

|

||||

Hello again and welcome to another episode of the series. We can finally leave behind the whole performance discussion from the anniversary... and go back to my unstructured, random rambles.

|

||||

|

||||

This month I finally read The Mandibles, after watching Odell recommend it for years. It was a great read. Went straight in, I think I finished it in a couple of days.

|

||||

|

||||

For those who are not familiar with it, The Mandibles is a fiction novel that describes the story of a US family after the USD stops being the global reserve currency. It's a crisp book that explains everything from the point of view of normal citizens. This makes it quite frightening. It's one thing to read about macro and check some doomporn on ZeroHedge, but reading a novel like this where you can pretty much smell the misery and fear through the pages hits truly hard. Even though I don't think the book is as deep or impactful as Atlas Shrugged, I would happily place both of them in a shelf of books that describe Bitcoiner's fears.

|

||||

|

||||

I don't want to spoil you too much, so feel free to drop here. But I must say that what scared me the most about this book is how boiling-frog-ish everything feels like. The characters of the story see their levels of freedom and material well being go lower, and lower, and lower, yet they pretty much just put up with it and adapt in very tactical ways for the most part. This makes me scared, because I fear that this might happen to many of us in real life. That if things are to go south, yet never at a pace fast enough to trigger us into risking violent, sudden changes and alternatives, we might just eat the whole thing and live miserably. I hope I'm wrong.

|

||||

|

||||

I recommend you to read it, and I also recommend it as a great book to gift to normies who still need to understand what's wrong with money. The book is not too technical, but it does a decent job at relating economic events to how they impact people's lives. It's also a quite emotional book, so that can be a great trigger to impact someone. Much better than recommending economics textbooks, probably.

|

||||

|

||||

On an unrelated topic, I wanted to share a link to [this gentleman's post on reddit](https://www.reddit.com/r/Bitcoin/comments/1etzbqw/25_year_update_i_took_out_125000_in_personal/). He's a US fella that's done a similar pattern to Operation Saylor, only way bolder. I thought you guys would appreciate going through it. I enjoyed his story, but what I enjoyed even more was going through the comments and noticing how the mood feels very different of what it felt like years ago. There was way more people supporting him: saying the whole move makes sense, congratuling the guy and even stating that they've done similar actions themselves. I feel years ago it would only have been people calling him a degenerate gambler, saying he just got lucky, mocking him and labeling him an idiot. Could it be that the Speculative Attack is slowly going mainstream, riding the arc from fringe to obvious?

|

||||

|

||||

I'll keep it short this month. As always, thanks for reading and I'll see you next month.

|

||||

|

||||

---

|

||||

|

||||

## Previous episodes

|

||||

|

||||

- Episode 1: [https://stacker.news/items/47539](https://stacker.news/items/47539)

|

||||

- Episode 2: [https://stacker.news/items/61708](https://stacker.news/items/61708)

|

||||

- Episode 3: [https://stacker.news/items/71794](https://stacker.news/items/71794)

|

||||

- Episode 4: [https://stacker.news/items/83670](https://stacker.news/items/83670)

|

||||

- Episode 5: [https://stacker.news/items/98216](https://stacker.news/items/98216)

|

||||

- Episode 6: [https://stacker.news/items/111818](https://stacker.news/items/111818)

|

||||

- Episode 7: [https://stacker.news/items/124601](https://stacker.news/items/124601)

|

||||

- Episode 8: [https://stacker.news/items/140816](https://stacker.news/items/140816)

|

||||

- Episode 9: [https://stacker.news/items/154229](https://stacker.news/items/154229)

|

||||

- Episode 10: [https://stacker.news/items/168432](https://stacker.news/items/168432)

|

||||

- Episode 11: [https://stacker.news/items/181336](https://stacker.news/items/181336)

|

||||

- Episode 12: [https://stacker.news/items/197688](https://stacker.news/items/197688)

|

||||

- Episode 13: [https://stacker.news/items/212587](https://stacker.news/items/212587)

|

||||

- Episode 14: [https://stacker.news/items/249798](https://stacker.news/items/249798)

|

||||

- Episode 15: [https://stacker.news/items/265819](https://stacker.news/items/265819)

|

||||

- Episode 16: [https://stacker.news/items/288719](https://stacker.news/items/288719)

|

||||

- Episode 17: [https://stacker.news/items/322189](https://stacker.news/items/322189)

|

||||

- Episode 18: [https://stacker.news/items/363765](https://stacker.news/items/363765)

|

||||

- Episode 19: [https://stacker.news/items/394704](https://stacker.news/items/394704)

|

||||

- Episode 20: [https://stacker.news/items/450792](https://stacker.news/items/450792)

|

||||

- Episode 21: [https://stacker.news/items/476945](https://stacker.news/items/476945)

|

||||

- Episode 22: [https://stacker.news/items/522161](https://stacker.news/items/522161)

|

||||

- Episode 23: [https://stacker.news/items/550749](https://stacker.news/items/550749)

|

||||

- Episode 24: [https://stacker.news/items/583121](https://stacker.news/items/583121)

|

||||

- Episode 25: [https://stacker.news/items/622095](https://stacker.news/items/622095)

|

||||

153

evangelism/episodes/episode_27.md

Normal file

|

|

@ -0,0 +1,153 @@

|

|||

# Operation Saylor - Episode 27/120

|

||||

|

||||

Hi again and welcome to another episode of the Operation Saylor. This is update number 27, corresponding to September 2024.

|

||||

|

||||

If you are reading this for first time, you might want to check [Episode 1](https://stacker.news/items/47539), where my plan and details are explained. That will get you in context.

|

||||

|

||||

---

|

||||

|

||||

## Stats

|

||||

|

||||

- BTC stack: 1.28537210BTC

|

||||

- € stack: 128.80 €

|

||||

- Current total value in €: 72,109.64 €

|

||||

- € into BTC: 30,000 €

|

||||

- Paid back to bank: 9,521.20 €

|

||||

- Outstanding debt + interests: 34,423.13 €

|

||||

- Installments to go: 94

|

||||

|

||||

|

||||

## Charts

|

||||

|

||||

[](https://postimg.cc/62Q6LgSg)

|

||||

[](https://postimg.cc/wybqWFYv)

|

||||

|

||||

---

|

||||

|

||||

## Log

|

||||

|

||||

Hello again and welcome to another episode of the series. This month, I've prepared a bit of an off-topic-ish rant on insurance and how Bitcoin has changed my relationship with them.

|

||||

|

||||

### Stories

|

||||

|

||||

Let me begin with three tiny stories.

|

||||

|

||||

First one: recently, a friend of mine who runs a brick and mortar business had some water leakage problems at his shop. He's not the owner of the space, he's renting. As per his rental agreement, it's the landlord who is responsible for taking care of this kind of stuff, so he got in touch. The landlord didn't raise any issues: he has an insurance for the shop space, so he just got in touch with the insurance company and once the claim was open, got my friend in the loop so he could take care of the logistics, which makes all the sense since my friend could better manage that to minimize disruption in his business.

|

||||

|

||||

What came after was a complete mess up. The insurance company seemed to respond promptly, but they just kept on sending clueless guys who would just take a look at the damaged stuff, make some silly guess on what was the root cause and attempted some half-assed approach to solving it. The fixes would never work for more than a couple of weeks, which led to my friend getting in touch again, and the insurance company sending off again a different guy, who still was clueless, and who obviously got absolutely no kind of handover from the previous guy. The new guys would proceed again to do his part, screw up, and fly off. This cycle repeated itself four times with four different handymen.

|

||||

|

||||

Finally, my friend, who at this stage was pretty close to throwing someone off a window, decided to call a handyman he trusted from years ago, unrelated to the business. Pretty frustrating, since it was the landlord's and his insurance responsibility, but the issue was disrupting his business operation enough that he was better off going down this path. The trusted handyman permanently fixed the issue in a single visit and charged only 250€.

|

||||

|

||||

Second one: a couple I'm friends with got pregnant a few months ago. They live in the UK. With the NHS being in shambles, they decided to manage the whole pregnancy through her private health insurance. They started with the first visits and everything was smooth and fine, until time came to run some tests to spot genetic issues in the baby, such as Down's syndrome. Low and behold, their doctor pointed out that there were multiple pretty good tests for that kind of issues, but that the insurance company wouldn't pay for them. Confused, since the couple thought everything related to the pregnancy would be included, the couple went back to the insurance terms and read the fine print. They found that the terms pretty much stated that everything and all tests were included, EXCEPT for these ones being discussed specifically. In the end, they just had to accept the terms and ended up paying that out of their pocket, which they told me cost a bit less than a 1000 pounds.

|

||||

|

||||

Third one: a relative of mine went on holiday to Greece this summer. Her and her direct family planned a roadtrip, so they rented a car in Athens from one of the typical big name companies you find at every airport. My relative, being as risk averse as you could imagine, went straight for the premium insurance that she got offered.

|

||||

|

||||

Unfortunately, they did have an accident a few days later. Luckily it was a minor crash in terms of personal damages for them, but on of the front corners of the car got pretty busted (they had to get a replacement car from the company since the one they had wasn't driveable after the impact). Towards the end of the trip, when they got back to the original office where they started the rental, the company workers informed that the insurance they had purchased didn't cover the damages on the rim and wheel that were hit. My relative got angry as fuck, because the wording of the insurance package was pure trickery to get you convinced it covered anything and everything. But just like with the previous couple insurance terms, the terms did state that wheel and rim damages weren't covered, so my relative had to pay up for that.

|

||||

|

||||

### The decision

|

||||

|

||||

I guess the point I'm heading to is pretty clear: insurance services of all sorts fucking suck.

|

||||

|

||||