Episdoe 13 and 14

This commit is contained in:

parent

fe02a29b74

commit

9386755384

7 changed files with 135 additions and 0 deletions

75

evangelism/episodes/episode_13.md

Normal file

75

evangelism/episodes/episode_13.md

Normal file

|

|

@ -0,0 +1,75 @@

|

||||||

|

# Operation Saylor - Episode 13/120

|

||||||

|

|

||||||

|

Hi again and welcome to another episode of the Operation Saylor. This is update number 13, corresponding to July 2023.

|

||||||

|

|

||||||

|

If you are reading this for first time, you might want to check [Episode 1](https://stacker.news/items/47539), where my plan and details are explained. That will get you in context.

|

||||||

|

|

||||||

|

---

|

||||||

|

|

||||||

|

## Stats

|

||||||

|

|

||||||

|

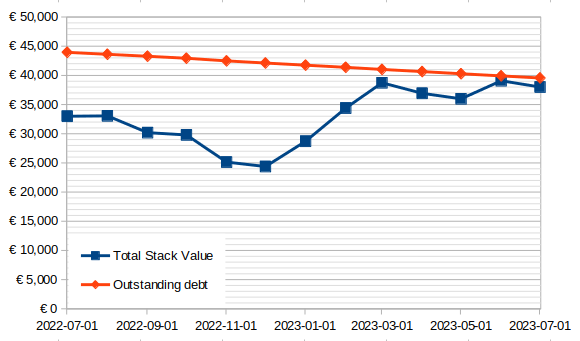

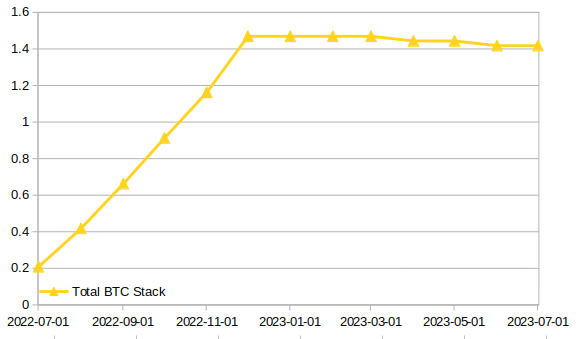

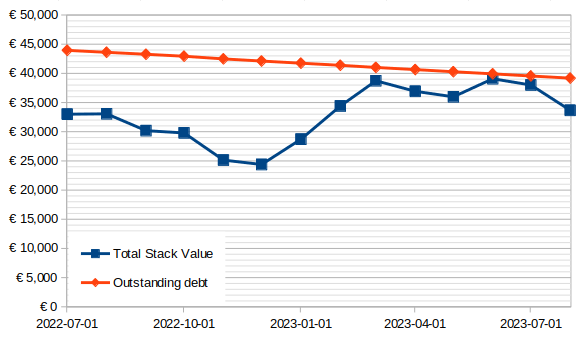

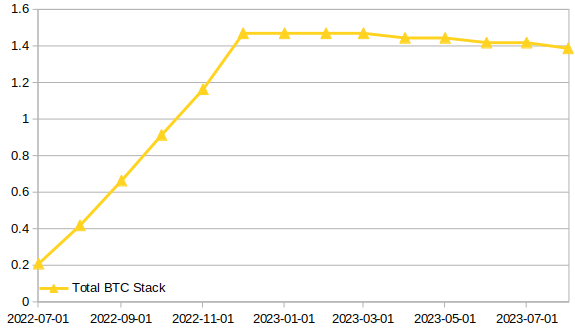

- BTC stack: 1.4179 BTC

|

||||||

|

- € stack: 5.60 €

|

||||||

|

- Current total value in €: 38,005.80 €

|

||||||

|

- € into BTC: 30,000 €

|

||||||

|

- Paid back to bank: 4394.40 €

|

||||||

|

- Outstanding debt: 39,549.93 €

|

||||||

|

- Installments to go: 108

|

||||||

|

|

||||||

|

|

||||||

|

## Charts

|

||||||

|

|

||||||

|

[](https://postimg.cc/XBvRb3K2)

|

||||||

|

[](https://postimg.cc/1gGh0v5K)

|

||||||

|

---

|

||||||

|

|

||||||

|

## Log

|

||||||

|

|

||||||

|

This month we hit the 1st anniversary of Operation Saylor! We have successfully gone through 10% of the loan payback period, life is good and we haven't lost any limbs along the way.

|

||||||

|

|

||||||

|

Time flies. Roughly one year ago, I was staring at the red tape for the bank loan. The idea of taking a loan to buy Bitcoin had been spinning around my brain for many months before that. After a long time of thinking at the same time that it was madness and also that it was obviously the right move, I found myself in a moment of

|

||||||

|

clarity and I pulled the trigger. It was a purely online transaction: I just had to login into my bank's webpage, click click click, and the 33,000€ appeared in my checking account instantly. Seeing how a bank makes money out of nothing so easily, without any human at the wheel, was a weird experience. A small sshow of the fiat crazyness, if you will.And then, I quickly got my hands dirty and started making the first purchases for the DCA-in plan.

|

||||||

|

|

||||||

|

I thought I could use this anniversary to make a small assessment on how the operation is going. Which drives me to take a step back and consider: how should success be measured? What are the criteria? Where is the bar? I think there are several ways to look at this, from simpler to more sophisticated.

|

||||||

|

|

||||||

|

The first that comes to mind is: I still have the BTC and haven't fucked up with self-custody. I shit you not, I'm much more scared about making a mistake on storing the corn than I am about the volatility and price risks of Operation Saylor. On this area, success is complete since I haven't lost a single sat.

|

||||||

|

|

||||||

|

Another simple way to look at it is the fact that I have been able to stick to the original plan completely. No unforeseen circumstances, crazy price variations or stupid decision-making from my side have taken place. I have followed the course of action that I originally drafted to the letter, and there is nothing in the horizon that makes me think that this won't be the case for the next year as well. I think this is important, since many times our plans don't fail because they are flawed, but because we sabotage them ourselves. So, by this measure, Operation Saylor is also on the path to success.

|

||||||

|

|

||||||

|

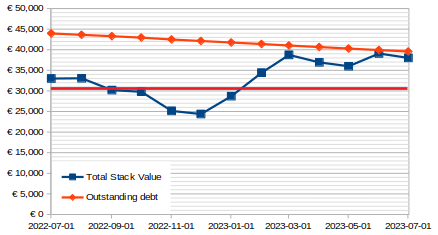

Jumping a little bit into numbers, there is a question that can be asked any time during the entire span of Operation Saylor: where would we stand if we paid back the loan completely today? This is real option that I always have, since my bank is willing to take early pay offs, up to the complete pending amount of the loan, at any time. This comes with a 1% penalty on top of the paid off amount.

|

||||||

|

|

||||||

|

My current pending debt with the bank is of 30,514.82 €. This is different from the 'Outstanding debt' that I usually show in the stats section and the charts because there, for simplicity's sake, I include all the interests that I will face if I stick to the original 10 years payments plan. So, 1% fee of 30,514.82 € is 305.15€, which adds up to a total of 30,819.97 €. Given that the current value of the stack is 38,005.80€, that means if I was to sell the corn and pay everything back, I would walk away with 7185.83 €. The chart below shows this. The horizontal red line represents the cost of paying back all the loan today.

|

||||||

|

|

||||||

|

[](https://postimg.cc/JsbHJWJY)

|

||||||

|

|

||||||

|

|

||||||

|

7K is not a life changing sum by any means, but it's a nice sum to get in exchange for 0 effort and 0 starting capital. It's also just nice because being in the green provides peace of mind in the sense that, if shit hits the fan right now for any reason in my personal life, Operation Saylor wouldn't be a net negative. Overall, I think this can also be considered a success, at least so far. Also, just to make things clear, I have no intent of paying back the loan early. Playing long-term is a key factor for the success of Operation Saylor, and I have no intent of timing any kind of early exit. So, unless misfortune strikes, we have 9 years ahead of us.

|

||||||

|

|

||||||

|

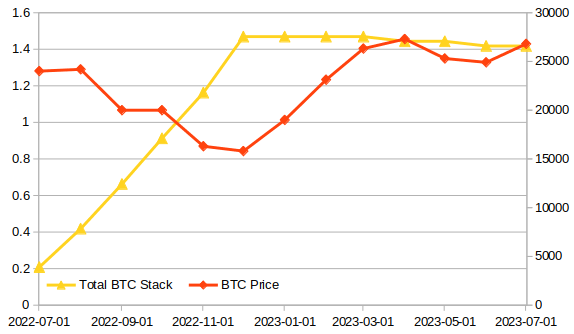

A final way to assess Operation Saylor is by analyzing the bitcoin cashflows together with the price. In the chart below you can see the usual line chart with the evolution of the bitcoin stack, combined with a secondary line and axis showing the evolution of Bitcoin's EUR price.

|

||||||

|

|

||||||

|

[](https://postimg.cc/SnzpRyB3)

|

||||||

|

|

||||||

|

This is truly a story of good luck so far. You can see how I DCA'd into a falling price during the first six months, which means it was a much better choice than to simply lump sum the loan principal immediately. This led to an average entry price of 20,420€/BTC. Afterwards, I spent three months without selling any corn, while the price of bitcoin ramped up from around ~15K to around ~25K. By the time I had to sell a bit of corn for the first time, the price was clearly above my entry price, and has remained hovering over there so far.

|

||||||

|

|

||||||

|

While this picture provides quite a sweet feeling, this isn't really defining the success of Operation Saylor. It's simply a good start, that could be followed by a terrible continuation or by more good luck. Only time will tell. Nevertheless, I can't deny that DCAing right into the bottom of the bear market is quite a badge I'm proud of. In any case, if Bitcoin does what we all more or less agree it should do in the following 9 years, these small details of the first year will probably disappear into oblivion unless we use a log chart. Which is exactly why playing long-term is key for success here.

|

||||||

|

|

||||||

|

I'm going to leave it here. In some upcoming episode, I might compare the performance so far against some hypothetical scenarios that I built before I started Operation Saylor, which I think could also be an interesting way to measure its success. But just with the simple judgments that I made above, I'm going to personally conclude that Operation Saylor has been a success so far. No mishaps, the plan still holds together, timing seems to have been great and we are in the green. What else can one ask for? I'm grateful things are the way they are and look forward to whatever may come.

|

||||||

|

|

||||||

|

Thanks for reading my thoughts during this year, and I'll see you around next month.

|

||||||

|

|

||||||

|

---

|

||||||

|

|

||||||

|

## Previous episodes

|

||||||

|

|

||||||

|

- Episode 1: [https://stacker.news/items/47539](https://stacker.news/items/47539)

|

||||||

|

- Episode 2: [https://stacker.news/items/61708](https://stacker.news/items/61708)

|

||||||

|

- Episode 3: [https://stacker.news/items/71794](https://stacker.news/items/71794)

|

||||||

|

- Episode 4: [https://stacker.news/items/83670](https://stacker.news/items/83670)

|

||||||

|

- Episode 5: [https://stacker.news/items/98216](https://stacker.news/items/98216)

|

||||||

|

- Episode 6: [https://stacker.news/items/111818](https://stacker.news/items/111818)

|

||||||

|

- Episode 7: [https://stacker.news/items/124601](https://stacker.news/items/124601)

|

||||||

|

- Episode 8: [https://stacker.news/items/140816](https://stacker.news/items/140816)

|

||||||

|

- Episode 9: [https://stacker.news/items/154229](https://stacker.news/items/154229)

|

||||||

|

- Episode 10: [https://stacker.news/items/168432](https://stacker.news/items/168432)

|

||||||

|

- Episode 11: [https://stacker.news/items/181336](https://stacker.news/items/181336)

|

||||||

|

- Episode 12: [https://stacker.news/items/197688](https://stacker.news/items/197688)

|

||||||

60

evangelism/episodes/episode_14.md

Normal file

60

evangelism/episodes/episode_14.md

Normal file

|

|

@ -0,0 +1,60 @@

|

||||||

|

# Operation Saylor - Episode 14/120

|

||||||

|

|

||||||

|

Hi again and welcome to another episode of the Operation Saylor. This is update number 14, corresponding to August 2023.

|

||||||

|

|

||||||

|

If you are reading this for first time, you might want to check [Episode 1](https://stacker.news/items/47539), where my plan and details are explained. That will get you in context.

|

||||||

|

|

||||||

|

---

|

||||||

|

|

||||||

|

## Stats

|

||||||

|

|

||||||

|

- BTC stack: 1.38666794 BTC

|

||||||

|

- € stack: 389.40 €

|

||||||

|

- Current total value in €: 33669.43 €

|

||||||

|

- € into BTC: 30,000 €

|

||||||

|

- Paid back to bank: 4,760.60 €

|

||||||

|

- Outstanding debt: 39,183.73 €

|

||||||

|

- Installments to go: 107

|

||||||

|

|

||||||

|

|

||||||

|

## Charts

|

||||||

|

|

||||||

|

[](https://postimg.cc/ygbqvsHz)

|

||||||

|

[](https://postimg.cc/k643QDLc)

|

||||||

|

---

|

||||||

|

|

||||||

|

## Log

|

||||||

|

|

||||||

|

Hello again and apologies for the delay. Life kept me away from my computer, hence why this episode of Operation Saylor has come a bit later than usual.

|

||||||

|

|

||||||

|

The reason that kept me far from my computer was a several-week trip to an Asian country. The trip has been amazing, and I have observed many of the differences between my home country and this land through Bitcoin and economic lenses. What I have learned makes me both hopeful and pessimistic. But the important thing is that I have learned a lot and seen things I would have never imagined could be true.

|

||||||

|

|

||||||

|

The streets of this country are the closest thing I've seen to anarcho-capitalism. There is an astoundingly diverse set of businesses, from fancy ones to very humble street stalls. Some commercial streets can have dozens of stalls in just a few meters, with an impressive life going on in them. All businesses will happily take cash, and actually, most of them will _only_ take cash. This is a stark difference from the situation in Europe, where cash is quickly going down the drain as people give it up. Credit cards are only accepted in some of the more fancy, serious, or large stores. Most street stalls have no licenses and, most surely, pay no taxes at all. Nobody seems to mind this, and policemen walk around happily as part of the scenery. It is obvious that the government surrenders to the fact that this mesh of street commerce is simply uncontrollable and just part of life, and so they tolerate it. Beautiful.

|

||||||

|

|

||||||

|

This lack of hard government control over small activities leads to a flourishing free market that offers competitive prices and a wide range of options. You can have lunch for $1 or $100 at restaurants next to each other. "Commodity meals", in the sense that they are pretty standard and widespread, pretty much have standard prices for comparable quality since no stall or restaurant dares to raise prices significantly with respect to its neighboring competitors. Transportation is another great example of a rich market: there are many different options to get from A to B, ranging from simply hopping on a motorcycle as a passenger to booking a luxury Mercedes. This can be done through mobile apps, but it can also be negotiated on the spot on the street. Again, it's all cash-based, even when booking transportation through apps. When observing the locals, it becomes obvious that rides are not reserved for the wealthy classes or the richer tourists, as I've seen in many European cities. Humble people rely on the cheapest transport options, like motorcycle taxis or shared vans. This achieves something that Western leftist governments always dream of but never nail down: removing the need for private ownership of vehicles. Why would I own a motorcycle if I can run my errands for an entire day for roughly the same price as a Mac Menu?

|

||||||

|

|

||||||

|

The prevalence of cash is both the consequence of a large part of the population being unbanked and also the reason that this anarcho-capitalism survives. Lots of people in the lower classes and rural areas rely completely on cash and don't have bank accounts or credit cards. Now, this obviously comes with negative consequences for them, since relying fully on cash and not having access to certain financial products is clearly not optimal at all. But at the same time, the collective unbanked mass is what makes any thought of deploying a CBDC wishful thinking. People successfully go on with their lives only with cash and are used to the freedom and simplicity that come with it. Hopefully, cash remains king for the time being and until the Bitcoin ecosystem has developed enough to support the exuberant economic life of the country.

|

||||||

|

|

||||||

|

I have enjoyed observing this society during my trip. I've seen things we used to enjoy in Europe that we have now lost. I've seen a mix of modernity without a hyper-financialized society where banks and governments have complete control over everyone's lives. And I've seen how wonderful it is. This makes me hopeful. There are still large chunks of the world where the fiat system has not fully taken control of things, and these resistance points stand in the way of the dystopian 1984 future we all fear. At the same time, I'm sad. I wonder how Europe went wrong. I am also doubtful of whether we can go back on the right track without going through traumatic times and some kind of nasty collapse before. I also think that more open societies like the one I visited are going to overtake us in terms of progress in a matter of a few decades, maybe just a few years. I can't help but feel like I'm on a sinking ship, all while I've just witnessed a brave small town with a buzzing shipyard that's building the ships of the future.

|

||||||

|

|

||||||

|

I hope I can visit this country again and learn more about it. In the meantime, I will be concerned with how I can keep my home from falling off the cliff, with the help of Bitcoin and all the plebs out here that are making society a better place.

|

||||||

|

|

||||||

|

As always, thanks for reading and I'll see you next month.

|

||||||

|

|

||||||

|

---

|

||||||

|

|

||||||

|

## Previous episodes

|

||||||

|

|

||||||

|

- Episode 1: [https://stacker.news/items/47539](https://stacker.news/items/47539)

|

||||||

|

- Episode 2: [https://stacker.news/items/61708](https://stacker.news/items/61708)

|

||||||

|

- Episode 3: [https://stacker.news/items/71794](https://stacker.news/items/71794)

|

||||||

|

- Episode 4: [https://stacker.news/items/83670](https://stacker.news/items/83670)

|

||||||

|

- Episode 5: [https://stacker.news/items/98216](https://stacker.news/items/98216)

|

||||||

|

- Episode 6: [https://stacker.news/items/111818](https://stacker.news/items/111818)

|

||||||

|

- Episode 7: [https://stacker.news/items/124601](https://stacker.news/items/124601)

|

||||||

|

- Episode 8: [https://stacker.news/items/140816](https://stacker.news/items/140816)

|

||||||

|

- Episode 9: [https://stacker.news/items/154229](https://stacker.news/items/154229)

|

||||||

|

- Episode 10: [https://stacker.news/items/168432](https://stacker.news/items/168432)

|

||||||

|

- Episode 11: [https://stacker.news/items/181336](https://stacker.news/items/181336)

|

||||||

|

- Episode 12: [https://stacker.news/items/197688](https://stacker.news/items/197688)

|

||||||

|

- Episode 13: [https://stacker.news/items/212587](https://stacker.news/items/212587)

|

||||||

BIN

evangelism/images/episode-13-bitcoin-stack-and-price.png

Normal file

BIN

evangelism/images/episode-13-bitcoin-stack-and-price.png

Normal file

Binary file not shown.

|

After Width: | Height: | Size: 24 KiB |

BIN

evangelism/images/episode-13-bitcoin-stack.png

Normal file

BIN

evangelism/images/episode-13-bitcoin-stack.png

Normal file

Binary file not shown.

|

After Width: | Height: | Size: 16 KiB |

Binary file not shown.

|

After Width: | Height: | Size: 21 KiB |

BIN

evangelism/images/episode-13-stack-value-vs-debt.png

Normal file

BIN

evangelism/images/episode-13-stack-value-vs-debt.png

Normal file

Binary file not shown.

|

After Width: | Height: | Size: 30 KiB |

BIN

register.xlsx

BIN

register.xlsx

Binary file not shown.

Loading…

Add table

Add a link

Reference in a new issue