96 lines

6.1 KiB

Markdown

96 lines

6.1 KiB

Markdown

|

|

# Operation Saylor - Episode 9/120

|

||

|

|

|

||

|

|

Hi again and welcome to another episode of the Operation Saylor. This is update number 9, corresponding to March

|

||

|

|

2023.

|

||

|

|

|

||

|

|

If you are reading this for first time, you might want to check [Episode 1](https://stacker.news/items/47539), where my

|

||

|

|

plan and details are explained. That will get you in context.

|

||

|

|

|

||

|

|

---

|

||

|

|

|

||

|

|

## Stats

|

||

|

|

|

||

|

|

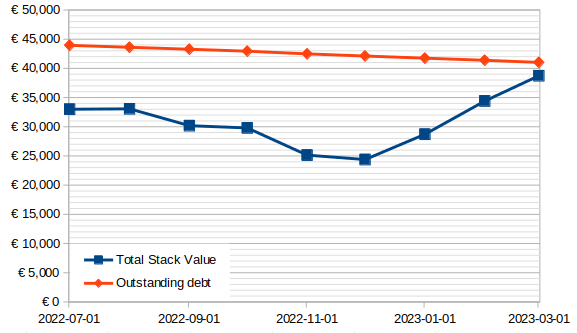

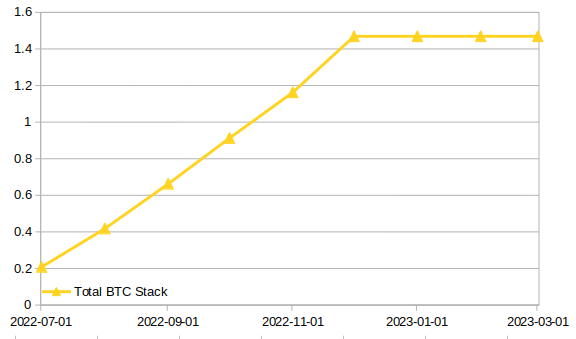

- BTC stack: 1.4692 BTC

|

||

|

|

- € stack: 70.40 €

|

||

|

|

- Current total value in €: 38,735.34 €

|

||

|

|

- € into BTC: 30,000 €

|

||

|

|

- Paid back to bank: 2,929.60 € ***

|

||

|

|

- Outstanding debt: 41,014.73 €

|

||

|

|

- Installments to go: 112

|

||

|

|

|

||

|

|

## Charts

|

||

|

|

|

||

|

|

[](https://postimg.cc/GHWqLK58)

|

||

|

|

|

||

|

|

[](https://postimg.cc/qzh1HSjH)

|

||

|

|

|

||

|

|

---

|

||

|

|

|

||

|

|

## Log

|

||

|

|

|

||

|

|

Another month drops by, a few banks are gone. March has definitely been an exciting month in terms of fiat crumbling.

|

||

|

|

And we still have a few days left, so we might need a bit more popcorn to get till the end of the show.

|

||

|

|

|

||

|

|

A few days ago I was discussing the whole shitshow with a bitcoiner friend of mine. She said she was enjoying it and

|

||

|

|

was excited to see more banks being hit by bank runs and the common public suddenly coming to understand that fiat

|

||

|

|

money isn't much more than words written with smoke.

|

||

|

|

|

||

|

|

As much as I fully understood her excitement (and I share it to some degree), I couldn't help but feel like Ben

|

||

|

|

Rickert in The Big Short as he headsout of the Vegas casino with his mentees. "Just don't fucking dance". I see a lot

|

||

|

|

of Bitcoiners rooting for a hardcore collapse of the fiat system that suddenly slingshots us into a forced

|

||

|

|

hyperbitcoinization. I find this worrying and a sign of ignorance, teenager like euphoria and short-sightedness.

|

||

|

|

|

||

|

|

I think the consequences of a break-neck paced hyperbitcoinization would be terrible. Obviously, hodlers would see

|

||

|

|

their networth skyrocket in the blink of an eye. But what would be the price to pay? Who's better off: the average

|

||

|

|

Joe of the current fiat system, or the richest man in Mad Max land?

|

||

|

|

|

||

|

|

I state the previous question assuming a sudden switch from the fiat standard to the bitcoin standard would have

|

||

|

|

apocalyptic effects on today's economy. Humans and other things that exist in meatspace, unlike software, data and

|

||

|

|

things that appear on screens, take time to change and can only adapt so fast to change. Picture our economy like a

|

||

|

|

natural ecosystem. Full of individual components that interact with each other in complex and hard to predict ways.

|

||

|

|

The cantillionares in the system would be this kind of parasite that is plugged into every living creature in this

|

||

|

|

ecosystem, corrupting and weakining everything it touches. Nevertheless, it is a part of this natural

|

||

|

|

ecosystem. It has placed itself in a central position, where it sucks life from many places and pukes it back into

|

||

|

|

others, taking a cut for its own benefit in the process. Even if it's a net negative for the overall health of the

|

||

|

|

ecosystem, it has become part of it. Somekind of an evil backbone.

|

||

|

|

|

||

|

|

What would happen if you cut all its tentacles swiftly? How many parts of the ecosystem would die without it? How long

|

||

|

|

would it take to have nature heal itself into its old glory? Coming back to real world terminology: how would our

|

||

|

|

complex supply chains keep the lights on if many banks fail in a month? How many people would stop working in the

|

||

|

|

face of not receiving their paychecks? How many suppliers would remove to send good to their customers without

|

||

|

|

receiving payments first? How many treasuries would suddenly vanish into the vod? How big of chunk of international

|

||

|

|

trade would come to a halt in the confusion that would derive from the USD dominance falling apart?

|

||

|

|

|

||

|

|

I think we shouldn't hope for the world to suddenly blow to shit just to see Bitcoin succeed overnight. Let's think

|

||

|

|

longterm. Let's think: how can we maintain and take care of all the great technical, social and intellectual

|

||

|

|

capital that we have built up to today, while getting rid of the cantillionare tentacles and shifting to a bitcoin

|

||

|

|

standard?

|

||

|

|

|

||

|

|

I'll tell you what I'm hoping for: I hope they print. I hope they print like there's not tomorrow. I hope they

|

||

|

|

bailout every single bank that shakes a tiny bit. Not because it is the right thing to do, we perfectly know it

|

||

|

|

isn't. Instead, I root for the printer because I believe it will do two things: on one hand, it will buy us more

|

||

|

|

time. More time to let bitcoin and the great technologies that surround it grow and mature. More time to bring more

|

||

|

|

young kids to the world, that will see bitcoin as a force of nature like the sun, since it will have existed "since

|

||

|

|

always" for them. More time for bitcoiners to keep on orange pilling all over the world, and specially in those

|

||

|

|

places where it's needed the most. More time to make circular economies come to life, creating patches of this

|

||

|

|

natural ecosystem that remain free of the cantillionaire monster and will do just fine once it dies. On the other

|

||

|

|

hand, uber-printing will through more gas into the fire of inflation, which is one of the great problems that

|

||

|

|

bitcoin is trying to solve. This will give everyone even more motivation to jump into the bitcoin wagon.

|

||

|

|

|

||

|

|

That will be it for this month. I wish you the best for the rest of march and I hope you have your popcorn ready.

|

||

|

|

|

||

|

|

---

|

||

|

|

|

||

|

|

## Previous episodes

|

||

|

|

|

||

|

|

- Episode 1: [https://stacker.news/items/47539](https://stacker.news/items/47539)

|

||

|

|

- Episode 2: [https://stacker.news/items/61708](https://stacker.news/items/61708)

|

||

|

|

- Episode 3: [https://stacker.news/items/71794](https://stacker.news/items/71794)

|

||

|

|

- Episode 4: [https://stacker.news/items/83670](https://stacker.news/items/83670)

|

||

|

|

- Episode 5: [https://stacker.news/items/98216](https://stacker.news/items/98216)

|

||

|

|

- Episode 6: [https://stacker.news/items/111818](https://stacker.news/items/111818)

|

||

|

|

- Episode 7: [https://stacker.news/items/124601](https://stacker.news/items/124601)

|

||

|

|

- Episode 8: [https://stacker.news/items/140816](https://stacker.news/items/140816)

|

||

|

|

|

||

|

|

*** You might have noticed this amount hasn't changed since episode 8. I made a mistake on episode 8. This month

|

||

|

|

figure is fine, and episode 8's should have been 2,563.40€.

|